Attractive Relative Yields from Muni Bonds

We believe recent municipal bond weakness is an opportunity to put money to work at lower prices than what we have seen for some time. High quality, triple-A rated municipal bonds with maturities between 13 to 23 years currently offer higher nominal yields than 10-year U.S. Treasuries, making them particularly attractive, as shown in the […]

Dec. 14 2016, Updated 12:05 p.m. ET

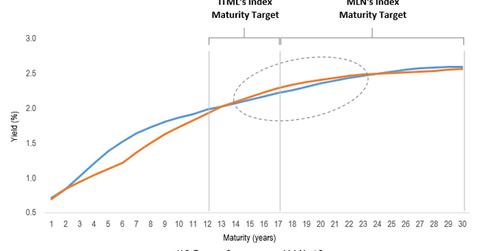

We believe recent municipal bond weakness is an opportunity to put money to work at lower prices than what we have seen for some time. High quality, triple-A rated municipal bonds with maturities between 13 to 23 years currently offer higher nominal yields than 10-year U.S. Treasuries, making them particularly attractive, as shown in the following chart. Muni investors can target this maturity range with VanEck Vectors™ AMT-Free 12-17 Year Municipal Index ETF (ITML) and VanEck Vectors™ AMT-Free Long Municipal Index ETF (MLN) which offer exposure to investment grade municipal bonds within their respective index’s target maturity range.

Yield Curves: High-Quality Municipal Bonds versus 10-Year U.S. Treasuries

As of 10/31/16

Source: Thomson Reuters and BofA Merrill Lynch.

Market Realist – Municipal bonds (MUB), or muni bonds, were the best performing asset class of 2015 and for most of 2016. However, there has been a sharp reversal of sentiment for muni bonds (ITML) in the past month. Investors withdrew a massive $3 billion from muni bond mutual funds and ETFs (MLN) in the week following the US presidential election. The Wall Street Journal, citing data from EPFR Global and Bank of America Merrill Lynch, has stated that this marks the largest pullback since June 2013. Several factors have contributed to this surge in muni bond yields.

There was a huge glut of supply as issued muni bonds (SHM) reached a record-breaking $52.5 billion in October, according to Reuters and the Los Angeles Times. The rise in supply was not met with as many takers, pushing down prices and pulling up yields—bond yields are inversely related to bond prices. Yields for quality ten-year muni bonds rose from a record low of 1.3% in August to 1.6% at the end of October, according to Merrill Lynch.

The situation was exacerbated by Donald Trump winning the US presidential election. Concerns over a policy overhaul and tax reforms by Trump have plagued the markets, as such reforms could mean abolishing tax exemption for muni bonds. Another concern rattling investors is that Trump’s commitment to increased infrastructure spending could lead to a higher issuance of muni bonds, which could further add to their supply and pull down prices in the future.

However, we believe that such concerns are overblown, especially in the short-to-medium term. According to predictions by Citigroup, bond sales, which have reached $250 billion so far this year, could plummet to $200 billion in 2017. Muni bond issuers have already tightened their issue calendar and are planning to sell $10 billion in bonds over the next month, a marked decrease from the $25 billion in sales in mid-October, according to Bloomberg.

Moreover, any changes to taxes and spending are not likely to come into effect over the next year. Therefore, the short-term appeal of bonds remains unencumbered.

With their high yields, low prices, and tax-efficient returns, muni bonds could prove to be a bargain for investors right now. Muni bonds are a value opportunity in today’s context.