Analyzing National Oilwell Varco’s Dividend

On August 18, National Oilwell Varco (NOV) approved to pay a quarterly dividend of $0.05 per share to shareholders on September 30.

Nov. 15 2016, Updated 11:04 a.m. ET

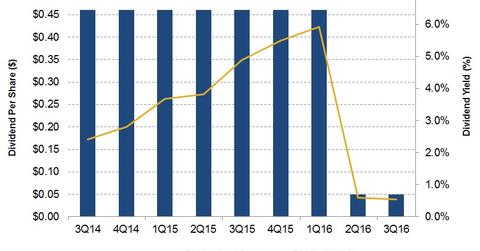

National Oilwell Varco’s dividend and dividend yield

On August 18, National Oilwell Varco (NOV) approved to pay a quarterly dividend of $0.05 per share to shareholders on September 30. It was 89% lower than a year ago. A steep and consistent fall in the net income prompted National Oilwell Varco’s dividend cut. Halliburton (HAL), its industry peer, kept its 3Q16 quarterly dividend unchanged at $0.18 compared to last year.

The dividend yield, expressed as dividend per share relative to the share price, rose from 3Q14 until 4Q15 before it crashed in 1Q16. From December 31, 2015, to September 30, 2016, National Oilwell Varco’s share price rose 10%, while its dividend per share fell sharply. Its dividend yield fell from 5.5% on December 31, 2015, to 0.54% on September 30, 2016.

Earlier, from 2009 to 2015, National Oilwell Varco’s share price fell 16%, while its dividend per share rose 67%. In effect, the dividend yield rose from 1.0% as of December 31, 2009, to 5.5% as of December 31, 2015.

Why National Oilwell Varco reduced its dividend

National Oilwell Varco reduced its dividend sharply in 2016 in order to respond to upstream companies’ lower capex spend. National Oilwell Varco’s management thinks that this would preserve capital to invest in future growth opportunities and enhance National Oilwell Varco’s core capabilities. National Oilwell Varco accounts for 0.14% of the iShares S&P 500 Value ETF (IVE).

In the following series on National Oilwell Varco, we’ll discuss its free cash flow, balance sheet, valuation multiples, and investor returns. Visit Market Realist’s Energy and Power page to learn more about the oil and gas industry.