Analyzing Morningstar’s Economic Moat Rating

Morningstar first began rating companies in 2002 according to the strength and longevity of their competitive advantages.

Nov. 1 2016, Updated 12:04 p.m. ET

Morningstar’s Economic Moat Rating

Morningstar first began rating companies in 2002 according to the strength and longevity of their competitive advantages. Nearly fifteen years later, Morningstar’s equity research process remains rooted in the core belief that quality companies positioned to maintain one or more competitive advantages well into the future are best positioned for long-term success. The quality of these companies is reflected in Morningstar’s Economic Moat Rating.

Morningstar’s unique Economic Moat Rating system helps investors identify how likely a company is to keep competitors at bay for an extended period. The highest rating, a wide economic moat, signifies Morningstar’s belief that the company can sustain its competitive advantage for at least 20 years into the future, which is no small feat in today’s ultra-competitive environment.

Market Realist – Morningstar’s research and investment philosophy

Morningstar’s research and investment philosophy is based on the concept of economic moats (MOAT). Morningstar believes companies (AMZN) (VAR) with a competitive advantage can earn higher returns on capital over a longer period. “Structural competitive advantage,” as defined by Morningstar, also allows a company to protect its market share in a dynamic business environment. Morningstar further believes that buying a stock is like buying a portion of a business. As a result, a comprehensive business evaluation is necessary in order to ensure long-term investing gains.

Market Realist – Ratings criteria

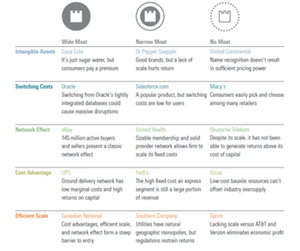

Morningstar’s economic moat is divided into three ratings: none, narrow, and wide. In order to identify companies that enjoy an economic moat, Morningstar assigns one of the three ratings.

Morningstar states, “There are two major requirements for firms to earn either a narrow or wide rating: 1) The prospect of earning above average returns on capital; and 2) Some competitive edge that prevents these returns from quickly deteriorating. A firm must have a competitive advantage inherent to its business in order to possess a moat. Great management, size, dominant market share, easily-replicable technology or efficiencies, and hot products are advantages to any businesses, but none of them is a structural advantage that can sustain high returns over a long period of time.”

On the other hand, companies with a rating of the wide economic moat (MSFT) (CSX) can maintain a competitive advantage for a longer period.