Mondelez Returns Billions of Dollars in Capital to Shareholders

In fiscal 1Q16, Mondelez returned a total of $1.5 billion in capital to shareholders through dividends and share repurchases.

July 22 2016, Updated 1:14 p.m. ET

Mondelez declared dividend

On July 19, Mondelez (MDLZ) announced that its board of directors approved a regular quarterly common share cash dividend of $0.19 per share of Class A common stock. The dividend will be paid on October 13, 2016, to shareholders of record on September 30, 2016.

Returns to shareholders to date

In fiscal 1Q16, Mondelez returned a total of $1.5 billion in capital to shareholders through dividends and share repurchases. Mondelez paid a total of $270 million to shareholders through dividends. In 2015, it paid $1 billion in dividends.

Over the last three years, the company has returned $11 billion of capital to shareholders, which includes around $3 billion in dividends and more than $8 billion in share repurchases. Mondelez has a dividend yield of 1.5% as of July 19, 2016. The company’s management has decreased its dividend at a CAGR (compounded annual growth rate) of 15% over the last five years.

Share repurchases

The company purchased $1.2 billion of stock, around 29 million shares at an average price of about $41. As the company announced earlier, it used $500 million of cash received as part of the JDE coffee deal to repurchase shares. The company still expects to buy back ~$2 billion of shares in fiscal 2016. In 2015 it bought back $3.6 billion of stock, which is around 92 million shares at an average price of $39.43 per share.

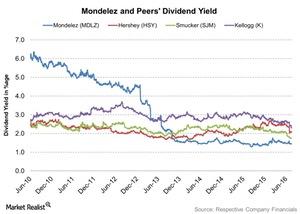

Peer dividend yield

Mondelez’s peers in the industry include Hershey (HSY), J.M. Smucker (SJM), and Kellogg (K). As of July 19, their dividend yields are as follows:

- Hershey: 2.1%

- J.M. Smucker: 1.9%

- Kellogg’s: 2.3%

The iShares S&P Global Consumer Staples ETF (KXI) invests 1.9% of its portfolio in MDLZ. The PowerShares QQQ Trust (QQQ) invests 1.3% of its holdings in MDLZ.