RPM International’s Fiscal 1Q17 Earnings Beat Analysts’ Estimates

RPM International reported adjusted EPS (or earnings per share) of $0.83, which beat analysts’ estimate of $0.80.

Oct. 7 2016, Published 11:29 a.m. ET

RPM International announces fiscal 1Q17 earnings

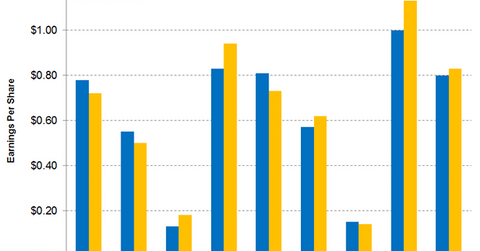

On October 5, 2016, RPM International (RPM) announced its fiscal 1Q17 earnings. RPM International reported adjusted EPS (or earnings per share) of $0.83, which beat analysts’ estimate of $0.80. The reported adjusted EPS for fiscal 1Q17 implies an increase of 12.2% on a year-over-year (or YoY) basis despite headwinds from currency exchange, weakness in the energy and heavy equipment industries, and a sluggish global economy. RPM reported adjusted EPS of $0.74 in fiscal 1Q16. RPM International’s financial reporting period is from June 1 to May 31.

Stock price movement

On the day of its earnings release, the stock fell 4.0% over the previous day’s close of $52.73. On the same day, the ProShares DWA Basic Materials Momentum Portfolio (PYZ) rose 0.25%. This ETF invests 2.8% of its holdings in RPM as of October 5, 2016. Since the beginning of 2016, RPM stock has risen 14.9% as of October 5. Below are the year-to-date (or YTD) returns of RPM’s peers as of October 5:

EPS guidance

RPM International provided full-year fiscal 2017 adjusted earnings per share guidance in the range of $2.68 to $2.78 and maintained its previously issued guidance.

In this series, we’ll look at the company’s fiscal 1Q17 earnings in detail and discuss the performance of each of its major segments. We’ll also look into its valuation in comparison with its peers. In the next part, we’ll look at RPM’s revenue for fiscal 1Q17.