PSEC Reduces Leverage amid Low Originations, Potential Rate Hike

Prospect Capital (PSEC) has used the low interest rate environment to its advantage by deploying higher leverage over the past couple of years.

Oct. 31 2016, Updated 10:04 a.m. ET

High repayments

Prospect Capital (PSEC) has used the low interest rate environment to its advantage by deploying higher leverage over the past couple of years. However, the company has been focusing on reducing its leverage in recent quarters, as originations have remained low, and the Federal Reserve is expected to hike interest rates before the end of 2016.

Prospect’s fiscal 4Q16 net debt-to-equity ratio fell to 69.5% compared to fiscal 4Q15’s debt-to-equity ratio of 73.8%. The fall was mainly due to the company’s repayment of debt from the proceeds of its Harbortouch Payments sale. The company has access to multiple funding options, providing it with flexibility for striking deals in a structured space.

Prospect Capital can resort to the monetization of equity stakes or market offerings in a bid to raise funds for business expansion. The prospect of raising funds through equity will come into the picture if PSEC can realize a premium over its existing net asset value. The company can also look at spin-offs and fresh debt fundraising as sources for raising capital.

By comparison, Prospect’s competitors have generated the following returns on equity deployment:

Together, these companies form 2.1% of the PowerShares Global Listed Private Equity ETF (PSP).

Targeting low-cost funds

Prospect’s cost of debt stood at 5.5% in fiscal 4Q16, compared to 6% one year earlier. The company managed this reduction by repaying high-cost debt and by using its revolving credit facility efficiently. PSEC has also garnered better deals on its existing credit facilities, with interest rates 50 basis points lower. Prospect’s revolving facility is carrying an Aa3 investment-grade rating from Moody’s.

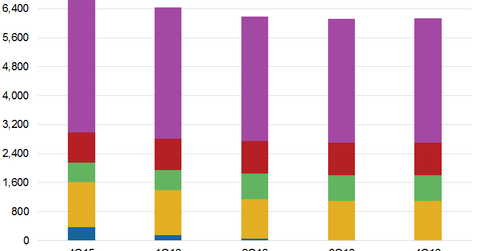

The company’s balance sheet is supported by repeat offerings of five- to 30-year unsecured term debt, resulting in an extension of its average liability duration. Prospect’s total assets had fallen to $6.3 billion as of June 30, 2016, compared to $6.8 billion in the previous year.

Now let’s discuss Prospect’s return on equity and fundraising.