Nike May Have Jordan, but Under Armour Boasts Phenom Curry

Although it’s a relatively new player in the sportswear industry, Under Armour has given tough competition to industry pioneers such as Nike (NKE) and Adidas (ADDYY).

Oct. 18 2016, Updated 1:04 p.m. ET

Under Armour: A Forbes Fab 40 brand

Founded in 1996, Under Armour primarily (UA) sells athletic apparel, footwear, and accessories. Although it’s a relatively new player in the sportswear industry, UA has given tough competition to industry pioneers such as Nike (NKE) and Adidas (ADDYY).

The UA brand has gained immense recognition in a very short span of time. It was ranked fourth in Forbes’ “Forbes Fab 40: The World’s Most Valuable Sports Brands 2015,” with a brand value estimated at $5 billion.

A look at Under Armour’s outstanding performance

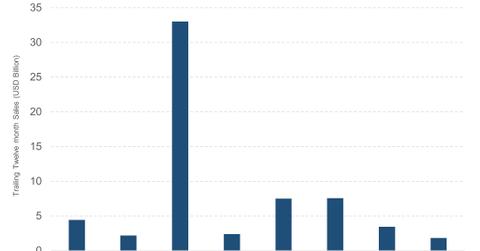

Under Armour has had a strong growth story. The company’s top line has risen at a CAGR (compound annual growth rate) of 25% in the last ten years, dwarfing the 7% growth seen by industry leader Nike during the same period.

What’s more interesting is that UA has expanded its top line by over 20% YoY (year-over-year) in the last 25 consecutive quarters. Though competitor Lululemon Athletica (LULU) has also displayed outstanding growth in the past ten years, with a CAGR of 30%, its top line growth has slowed to the low double digits to mid-teens over the past two to three years.

What’s behind UA’s strong growth?

Innovative fabrics and designs, product line expansion, a highly visible marketing campaign, and celebrity endorsements have fueled UA’s top line growth.

The company’s footwear business, which launched in 2006, has shown phenomenal growth. This category has grown five times over the past five years. The company’s Curry series, named after last season’s NBA MVP (most valuable player), Stephen Curry, has been a huge success. To know more about the company’s footwear business, read Part Four of this series.

UA’s international sales have also been key to its growth. Its sales in the overseas market (outside North America) have grown at a CAGR of around 50% since 2010. To know more about the growth in the company’s international and domestic businesses, read on to the next article.

As a company with strong growth prospects, UA is included in many ETFs that invest in companies with growth slants. The company makes up 0.55% of the Guggenheim S&P 500 Pure Growth ETF (RPG).