Looking to Local-Currency Emerging Market Bonds for Opportunities

In today’s context, emerging market bonds (IGEM) look like good opportunities for investors.

Oct. 24 2016, Updated 1:05 p.m. ET

Emerging Markets Local Currencies Still Cheap?

To get a better sense of emerging markets more broadly, the chart below represents a weighted average of the countries currently represented in the J.P. Morgan GBI-EM Core Index (the “Index”), using country weights of the Index as of August 31, 2016. Despite recent strength beginning in February of this year, emerging markets REERs are still well below the levels experienced in the past decade and are still approximately at the level following the financial crisis in 2009. One possible conclusion is that emerging markets local currencies were, on average, oversold following the taper tantrum and the collapse in commodity prices and may still have room to appreciate before trading at more normalized levels. Rate hikes in the U.S. may provide a headwind, but lower rates for longer still appear likely and the U.S. dollar has already strengthened significantly over the past three years. Additionally, improving fundamentals, generally low inflation, and a stabilization in commodity prices may continue to be a tailwind to emerging markets local currency appreciation.

Emerging Markets Real Effective Exchange Rate Average

January 1994 – August 2016

Source: Bloomberg.

Emerging markets local currency bonds provide investors with two distinct sources of return: local bond yields and potential currency appreciation. Investors can access bonds issued by emerging markets governments and denominated in local currencies with VanEck Vectors J.P. Morgan EM Local Currency Bond ETF (EMLC).

Market Realist – Local-currency emerging market bonds

In today’s context, emerging market bonds (IGEM) look like good opportunities for investors. With investors continuing to seek out income in the presence of low yields in the developed world, fixed income in emerging markets (EMAG) looks to be a good investment bet. Persistently low yields in the developed world (as you can see in the graph above), strengthening emerging market currencies, and attractive valuations relative to the developed world remain tailwinds for emerging market bonds.

According to data from BlackRock, emerging market bond ETFs (EMB) (PCY) attracted a record $5.8 billion in net inflows in Q3 2016. This total marks the largest quarterly monetary inflow on record (Sources: Thomas Hale, the Financial Times; NASDAQ). Emerging market bonds have attracted $12.7 billion in inflows year-to-date.

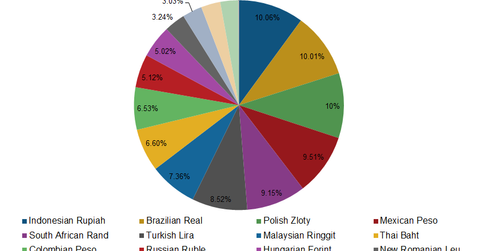

The VanEck Vectors J.P. Morgan EM Local Currency Bond ETF (EMLC) tracks currency-denominated emerging market bonds. It could prove to be a good opportunity for investors. The ETF holds net assets worth more than $2.4 billion, and it sports a duration of 5.01 years as well as a 30-day Securities and Exchange Commission or SEC yield of 5.31%. The ETF was giving stellar year-to-date returns of 16.28% on a net asset value basis and 16.76% on a share price basis as of September 30, 2016. The graph above shows the breakdown of currency exposure for the ETF.

Strengthening emerging market currencies or a weakening US dollar (UUP) should continue to bolster returns from local-currency emerging market bond ETFs.