Guggenheim Has Rated PVH Corporation a ‘Buy’

PVH Corporation (PVH) has a market cap of $8.9 billion. It rose 3.6% to close at $110.50 per share on September 30, 2016.

Oct. 4 2016, Updated 11:04 a.m. ET

Price movement

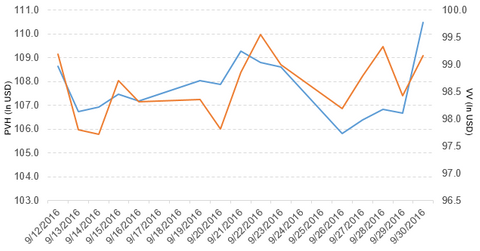

PVH Corporation (PVH) has a market cap of $8.9 billion. It rose 3.6% to close at $110.50 per share on September 30, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 1.8%, 2.5%, and 50.2%, respectively, on the same day.

PVH is trading 2.5% above its 20-day moving average, 5.4% above its 50-day moving average, and 21.5% above its 200-day moving average.

Related ETF and peers

The Vanguard Large-Cap ETF (VV) invests 0.05% of its holdings in PVH. The ETF tracks a market-cap-weighted index that covers 85% of the market capitalization of the US equity market. The YTD price movement of VV was 7.7% on September 30, 2016.

The market caps of PVH’s competitors are as follows:

PVH’s rating

Guggenheim has initiated coverage of PVH Corporation with a “buy” rating and set the stock’s price target at $125 per share.

Performance of PVH in fiscal 2Q16

PVH reported fiscal 2Q16 revenue of $1.93 billion, a rise of 3.8% compared to $1.86 billion in fiscal 2Q15. Revenues for its Calvin Klein and Tommy Hilfiger segments rose 12.0% and 6.1%, respectively. Revenue for its Heritage Brands segment fell 14.3% in fiscal 2Q16 compared to fiscal 2Q15.

The company’s gross profit margin and EBIT (earnings before interest and tax) fell 0.74% and 7.2%, respectively, in fiscal 2Q16 compared to the prior year’s period. Its net income and EPS (earnings per share) fell to $90.5 million and $1.11, respectively, in fiscal 2Q16 compared to $102.2 million and $1.22, respectively, in fiscal 2Q15. It reported non-GAAP (generally accepted accounting principles) EPS of $1.47 in fiscal 2Q16, a rise of 7.3% compared to fiscal 2Q15.

PVH’s cash and cash equivalents and inventories rose 58.9% and 0.68%, respectively, in fiscal 2Q16 compared to fiscal 2Q15. Its debt-to-equity ratio fell to 1.3x in fiscal 2Q16 compared to 1.4x in fiscal 2Q15.

Projections

The company has made the following projections for fiscal 2016:

- rise in revenue of 2% on a GAAP basis and 3% on a constant currency basis; revenue for Calvin Klein, Tommy Hilfiger, and Heritage Brands of 5%, 5%, and -8%, respectively, on a GAAP basis

- net interest expense of $117.0 million–$120.0 million

- non-GAAP EPS of $6.55–$6.65, which includes a negative impact related to foreign currency exchange rates of $1.60 per share

- effective tax rate of 20% on a non-GAAP basis

The company has made the following projections for fiscal 3Q16:

- rise in revenue of 3% based on a constant currency and GAAP basis

- net interest expense of $30 million

- non-GAAP EPS of $2.35–$2.40, which includes the negative impact of foreign currency exchange rates of $0.45 per share

- effective tax rate of 16%–17%

In the next part, we’ll look at Skechers USA (SKX).