What Do Expedia’s Key Metrics Suggest?

For the last year, Expedia’s gross bookings increased 28% after increasing 16% for the two years before that. For the first nine months of 2015, gross bookings have increased 20%.

Feb. 16 2016, Updated 9:05 p.m. ET

Gross bookings grow

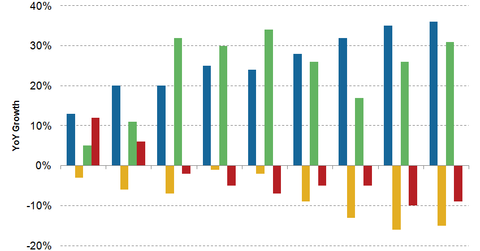

Gross bookings are the metric used to measure the total value of all travel services purchased by customers. Gross bookings for Expedia (EXPE) increased 21% in 3Q15, driven by strong growth in the core OTA (online travel agency) business. On a constant dollar basis, gross bookings increased 26%.

For the last year, Expedia’s gross bookings increased 28% after increasing 16% for the two years before that. For the first nine months of 2015, gross bookings have increased 20%. On a constant dollar basis, growth would be much higher.

Rivals Priceline (PCLN), TripAdvisor (TRIP), and Ctrip.com (CTRP) have reported high growth in gross bookings from hotels.

Room nights increase, revenue per room night declines

Hotels account for 72% of EXPE’s revenues. Room nights continue to increase at a strong pace driven by both Expedia and Hotels.com. Room nights increased ~24% in 2014 and ~34% in the first three quarters of 2015.

However, revenue per room night has been declining for the past ten quarters. Unfavorable currency fluctuations are one of the important reasons. Declining average daily rates (or ADRs) have also contributed to the decline. Increasing global hotel supply has pressured ADRs.

Air tickets grow, revenue per ticket declines

Sales of online air tickets have also increased in the last few quarters. After increasing 31% in 2014, sales increased by almost 25% in first nine months of 2015. However, as airfares have declined, revenue per ticket has also been declining. Air ticket sales form 7% of EXPE’s total revenue.

Advertising and media

Advertising is currently EXPE’s fastest growing business, but it accounts for only 8% of its revenues. For the first nine months, advertising grew by 20% year-over-year.

The strong volume growth in both hotels and air tickets will continue to offset the impacts of declining revenue per room night/ticket, helping EXPE capture revenue growth. The strong advertising business will continue to contribute to this growth.

EXPE forms ~1.4% of the Guggenheim S&P 500 Pure Growth ETF (RPG).