Synergies of the Charter–Bright House–Time Warner Cable Merger

Early this year, Charter Communications (CHTR) completed its merger with Time Warner Cable and Bright House Networks, making Charter the second-largest US cable player.

Oct. 24 2016, Updated 4:29 p.m. ET

The Charter–Bright House–Time Warner Cable merger

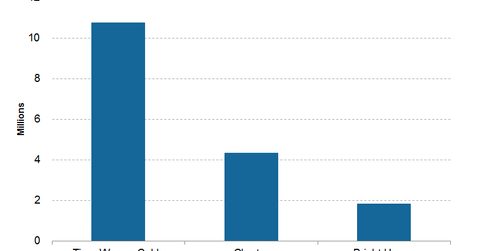

Early this year, Charter Communications (CHTR) completed its merger with Time Warner Cable and Bright House Networks. With this merger, the new Charter Communications is the second-largest US cable player after Comcast (CMCSA). The combined entity had ~25.6 million customer relationships and ~48.8 million passings by the end of 2Q16.

Charter has started the process of deploying its pricing and promotion strategies and its network strategy across the two new businesses.

Merger synergies

The large video base of the new Charter may help the company negotiate with media networks for content costs. The company expects to realize ~$800 million in merger synergies through 2018 with a reduction in programming costs. Charter plans to increase product penetration levels for the combined entity, which should boost its unit revenue per household.

Charter faces increasingly intense competition in the cable industry, with satellite broadcasters DirecTV and Dish TV (DISH) the greatest current threats. DirecTV was acquired by AT&T (T) last year, making it the largest pay-TV player in the United States. AT&T and Verizon (VZ) are also ramping up comparable service offerings, including video, high-speed Internet, and digital phones. They’re combining them with wireless services that further intensify competition in the cable market. Bundling various services helps these companies reduce customer churn.

In the next part of this series, we’ll look at Charter’s position in the US pay-TV market after the merger.