What Could Drive Sherwin-Williams’ Revenue Growth in 1Q17?

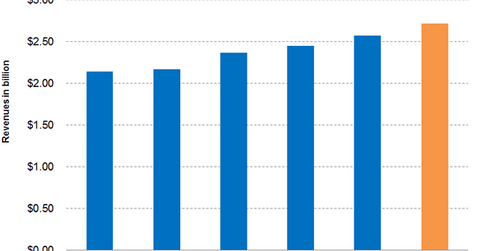

With Sherwin-Williams (SHW) expected to announce its 1Q17 earnings on April 20, 2017, analysts expect it to post revenue of $2.72 billion in 1Q17, a rise of 5.6% year-over-year (or YOY).

April 12 2017, Updated 11:36 a.m. ET

Analysts expect Sherwin-Williams’ revenue to rise 5.6%

With Sherwin-Williams (SHW) expected to announce its 1Q17 earnings on April 20, 2017, analysts expect it to post revenue of $2.72 billion in 1Q17, a rise of 5.6% year-over-year (or YOY).

In the past five years, Sherwin-Williams’ first-quarter revenues have risen at CAGRs (compound annual growth rate) of 4.6%, from $2.1 billion in 1Q12 to $2.6 billion in 1Q16. Analysts expect the trend to continue in 1Q17.

What could drive Sherwin-Williams’ revenue growth?

SHW’s Paint Stores segment is its major revenue driver. In 1Q16, the segment reported revenue of $1.6 billion, representing more than 62% of SHW’s total revenue. Its expected rise in revenue in 1Q17 could be driven by the increase in its number of paint stores. At the end of 1Q16, SHW had 4,099 paint stores. At the end of 4Q16, this number had risen to 4,180.

At the same time, the upward trend in the architectural business is expected to continue. The new home sales trend has remained positive. In January and February 2017, data indicated upward trends over the previous year.

Further, the strengthening of Latin American currencies, especially the Brazilian real and the Argentine peso, could help to curb the falling trend in SHW’s Latin American segment.

Investors can indirectly hold Sherwin-Williams by investing in the Vanguard Materials ETF (VAW), which has invested 2.9% of its portfolio in SHW. The top holdings of the fund include Dow Chemical (DOW), DuPont (DD), and Monsanto (MON) with weights of 8.4%, 8.3%, and 6.1%, respectively, as of April 11, 2017.

In the next article, we’ll look at analysts’ earnings estimates for Sherwin-Williams’ 1Q17.