Can McDonald’s Beat Analysts’ Earnings Estimates Again in 3Q16?

In the last four quarters, McDonald’s has beaten analysts’ estimates. In 3Q16, analysts are expecting the company to post EPS of $1.48, a year-over-year rise of 6.1%.

Dec. 4 2020, Updated 10:53 a.m. ET

Earnings per share

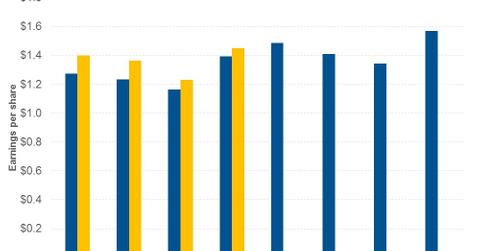

So far in this series, we’ve looked at McDonald’s (MCD) estimated revenue, sources of revenue, and estimated EBIT (earnings before interest and tax) margins. Now we’ll take a look at analysts’ EPS (earnings per share) estimates and management’s guidance for fiscal 3Q16.

3Q16 estimates

From the above graph, you can see that in the last four quarters, McDonald’s has beaten analysts’ estimates. In 3Q16, analysts are expecting the company to post EPS of $1.48, which represents a year-over-year rise of 6.1%.

Although overall estimated revenue is expected to fall 5.0%, higher EBIT margins and more share repurchases in the last 12 months are expected to drive McDonald’s earnings in 3Q16. We’ll look more at share repurchases in the next part.

Company management has stated that the strong dollar could negatively impact 3Q16 EPS by $0.02–$0.04 and fiscal 2016 EPS by $0.09–$0.11.

Peer comparison

In 3Q16, analysts are expecting EPS for Wendy’s (WEN), Jack in the Box (JACK), and Restaurant Brands International (QSR) to rise 25.0%, 20.5%, and 51.9%, respectively.

Outlook

With EBIT margins expected to expand for the rest of fiscal 2016, and with $5.6 billion available to be returned to shareholders either through dividends or share repurchases in fiscal 2016, analysts are expecting McDonald’s to post EPS of $5.60 in fiscal 2016. That represents a year-over-year rise of 12.7%.

In 1Q17 and 2Q17, analysts are expecting McDonald’s to post EPS of $1.34 and $1.56, respectively, which represents a year-over-year rise of 9.2% and 8.2%, respectively.

Next, we’ll look at McDonald’s dividend payout policy.