Analyzing the Bullish Argument for U.S. Steel

The bulls and bears have their own sets of arguments about U.S. Steel. U.S. Steel (X) and AK Steel (AKS) mainly use iron ore as a raw material.

Oct. 20 2016, Published 1:31 p.m. ET

Bullish argument

Previously, we looked at the divergence in analysts’ opinions about U.S. Steel (X). The bulls and bears have their own sets of arguments about U.S. Steel. In this part, we’ll look at some of the arguments that the bulls (SSO) are putting forward.

Higher raw material prices

Iron ore, steel scrap, and coking coal are the key raw materials that go into steel production. While US steel companies including Nucor (NUE) and Steel Dynamics (STLD) rely mainly on steel scrap, U.S. Steel and AK Steel (AKS) mainly use iron ore as a raw material.

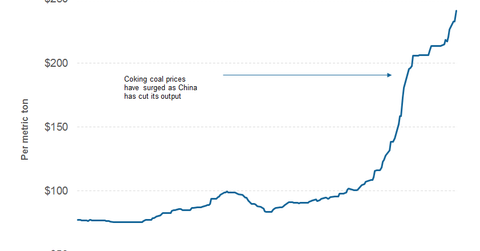

Iron ore prices have shown resilience. Coking coal has actually been the best-performing commodity this year. The prices more than tripled since the beginning of the year. We should remember that although coking coal and iron ore prices don’t have much impact on US steel prices in the short term, they tend to impact steel prices in most other countries.

As input costs rise for steelmakers, especially in China, steel prices would also get support. Steel companies would resist any fall in steel prices to protect their margins. Some steelmakers could even look at price hikes to protect their profitability in the wake of rising input costs. Stable international prices would also support US steel prices.

Narrowing spreads

While US steel prices have fallen over the last two months, they have been stable elsewhere. As a result, the spread between the US and international steel prices narrowed from its record highs. Narrowing spreads would reduce the attractiveness of imported steel products for US steel consumers. It would prompt them to place orders with domestic steel mills.

U.S. Steel bulls have a few more arguments in their arsenal. We’ll discuss these in the next part of the series.