Will Treasury Inflation-Protected Securities Be a Game-Changer?

According to Bloomberg, Treasury Inflation-Protected Securities (or TIPS) have generated a year-to-date return of 6.3% compared to 4.7% by the broad Treasury market.

Sept. 30 2016, Updated 4:33 p.m. ET

Flows into U.S. Treasury bonds have been more mixed. Nominal Treasury securities have had small net outflows, a big change from the large outflows they experienced leading up to the June Fed meeting. Meanwhile, Treasury Inflation-Protected Securities (or TIPS) had some inflows as investors position for potentially higher inflation down the road.

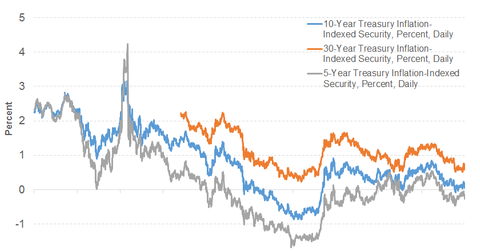

Market Realist –Demand for Treasury Inflation-Protected Securities is expected to rise

According to Bloomberg, Treasury Inflation-Protected Securities (or TIPS) have generated a year-to-date return of 6.3% compared to 4.7% by the broad Treasury market. The popularity of TIPS was reflected by the sale of ten-year TIPS worth $11 billion on September 22, 2016, providing a yield of 0.052%.

TIPS gained immediate attention as the value of bonds rose with inflation. The sale of TIPS is bound to gain further momentum as the United States gets closer to the target inflation rate due to rising costs of homes and medical care. So TIPS are expected to see a rise in volumes due to their competitive pricing compared to nominal Treasury bonds and as concerns over rising inflation rise.

Below are some year-to-date returns for ETFs: