Why Most Analysts Have Rated Steel Dynamics as a ‘Buy’

Steel Dynamics has one of the most diversified end-market exposures compared to other steel companies.

Nov. 20 2020, Updated 2:31 p.m. ET

Steel Dynamics

Among the stocks we are covering, Steel Dynamics (STLD) has received the highest percentage of “buy” or equivalent recommendations from analysts at 70%. According to the consensus estimates compiled by Bloomberg, Steel Dynamics carries a one-year price target of $30.71, which represents a 24.7% upside over August 31 closing prices.

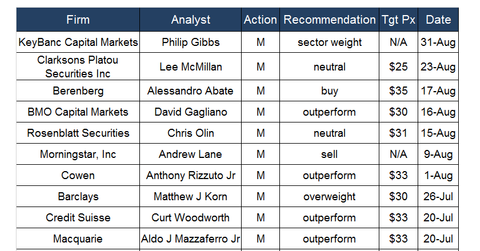

The graph above shows recent Wall Street analyst recommendations for Steel Dynamics. On August 23, Clarksons Platou Securities maintained its “neutral” rating on the company with a one-year price target of $25. Berenberg is among the most bullish brokerages on Steel Dynamics and has set a one-year price target of $35. This represents a 42% upside over current price levels.

Let’s now see why most analysts seem to be bullish (SSO) on Steel Dynamics.

Diversified exposure

Steel Dynamics has one of the most diversified end-market exposures compared to other steel companies. For example, AK Steel (AKS) gets more than half of its revenues from the automotive sector, while Nucor (NUE) relies heavily on non-residential construction demand. Diversified end-market exposure reduces a company’s risk profile, as the weakness in one customer segment doesn’t have a big impact on earnings.

Last year, U.S. Steel’s (X) performance was hit by the weakness in the energy market. However, this year, U.S. Steel’s flat rolled segment has more than made up for the weakness in the energy market. You can read Why the Best of U.S. Steel’s Flat Rolled Segment Is Yet to Come to explore this more.

Strong balance sheet

Steel Dynamics has a healthy balance sheet. The company’s financial strength should help it survive the current steel industry slowdown. It should do better than the more financially levered companies such as U.S. Steel and AK Steel if steel market conditions worsen in the coming months.

We’ve already seen steel industry indicators deteriorate in July and August. You can read What Will Santa Bring for US Steel Producers This Christmas? to learn more about this.