What Short Interest in Weatherford Indicates

Weatherford International’s (WFT) short interest as a percentage of its float was 14.9% as of May 22, 2017, compared to ~14% as of March 31, 2017.

Nov. 20 2020, Updated 3:39 p.m. ET

Short interest in Weatherford International

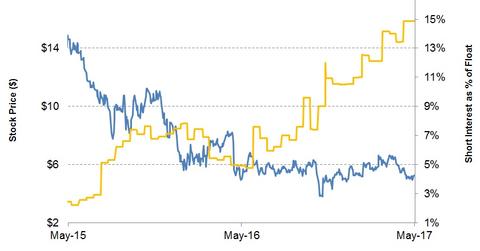

Weatherford International’s (WFT) short interest as a percentage of its float was 14.9% as of May 22, 2017, compared to ~14% as of March 31, 2017. Since the end of 1Q17, WFT’s short interest has risen 6%. As the graph below shows, WFT’s stock price and short interest as a percentage of float have been inversely related since May 2015.

WFT makes up 3.2% of the iShares US Oil Equipment & Services ETF (IEZ). WFT also makes up 0.02% of the iShares Russell 3000 ETF (IWV). The energy sector makes up 5.8% of IWV. IWV tracks the Russell 3000 Index (RUA-INDEX). The index is composed of 3,000 large companies in the US. The RUA-INDEX rose 18% in the past one year versus a 5% rise in WFT’s stock price.

Implications of short interest in Weatherford International

Short interest is the number of shares sold short divided by the number of shares outstanding. An increase in short interest as a percentage of float, or a rise in short interest, indicates that more investors think the stock’s price will fall. Since March 31, 2017, WFT’s stock price has fallen ~21%, reflecting the rise in short interest.

However, investors should remember that the market could go against investors’ sentiment. Also, the stock price could rise when investors start buying the stock to cover their short positions.

Learn more about the OFS industry in Market Realist’s What Oilfield Services Companies’ Forward Multiples Indicate.