Rising Volatility Continues to Affect Miners’ Stocks

The precious metals price correction that happened on September 2, 2016, extended to September 6. How did equities and funds respond?

Sept. 8 2016, Published 2:29 p.m. ET

Revived sentiment

The precious metals price correction that happened on September 2, 2016, extended to September 6. The Physical Swiss Gold Shares ETF (SGOL) and the PowerShares DB Gold ETF (DGL) fell by 0.27% and 0.53%, respectively, on September 7. The funds maintained trailing-five-day gains of 2.7% and 2.6%, respectively.

As discussed in the second article of this series, gold’s and silver’s volatilities rose, and so did the volatilities of precious metals miners such as Barrick Gold (ABX), AngloGold Ashanti (AU), and Hecla Mining (HL). Together, these three companies contribute a whopping 12.6% to the fluctuations in the VanEck Vectors Gold Miners ETF (GDX).

Implied volatility

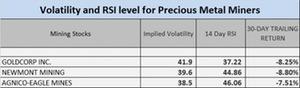

Call-implied volatility takes into account the changes in the price of an asset with respect to variations in the price of its call option. Volatility is higher during times of global and economic turbulence than it is in a stagnant economy.

The volatilities of ABX, AU, and HL were 45.3%, 49.1%, and 58.1%, respectively, on September 7, 2016.

RSI

The RSIs (relative strength index) for these three giant miners also rose considerably on September 7. Barrick, AngloGold, and Hecla saw RSI levels of 44.3, 41, and 52.8, respectively. Their RSI levels rose with their rises in price.[1. An RSI level of above 70 indicates that a stock has been overbought and could fall, while an RSI level of below 30 indicates that a stock has been oversold and could rise.]

The trailing-30-day returns of these miners were negative as of September 7, but they’re slowly entering into positive territory.