PKG Declares Dividend of $0.63 Per Share

Packaging Corporation of America (PKG) has a market cap of $7.4 billion. It fell by 0.99% to close at $78.63 per share on August 31, 2016.

Sept. 1 2016, Updated 6:04 p.m. ET

Price movement

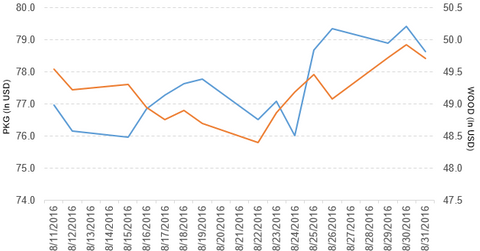

Packaging Corporation of America (PKG) has a market cap of $7.4 billion. It fell by 0.99% to close at $78.63 per share on August 31, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 3.5%, 6.5%, and 27.0%, respectively, on the same day. PKG is trading 2.5% above its 20-day moving average, 7.6% above its 50-day moving average, and 24.9% above its 200-day moving average.

Related ETF and peers

The iShares Global Timber & Forestry ETF (WOOD) invests 3.8% of its holdings in PKG. The ETF tracks the 25 largest publicly listed companies that own or manage forests and timberlands. The YTD price movement of WOOD was 4.1% on August 31.

The market caps of PKG’s competitors are as follows:

PKG declares dividend

Packaging Corporation of America has declared a quarterly cash dividend of $0.63 per share, a rise of 15%, on its common stock. The dividend will be paid on October 14, 2016, to shareholders of record as of September 15, 2016.

Performance of Packaging Corporation of America in 2Q16

Packaging Corporation of America reported 2Q16 net sales of $1.42 billion, a fall of 2.5% from the net sales of $1.45 billion in 2Q15. Sales of the packaging and paper segments fell by 1.5% and 5.1%, respectively, between 2Q15 and 2Q16. The company’s gross profit margin and income from operations rose by 3.4% and 1.3%, respectively.

Its net income and EPS (earnings per share) rose to $115.9 million and $1.23, respectively, in 2Q16, compared with $114.0 million and $1.16, respectively, in 2Q15. It reported EBITDA (earnings before interest, tax, depreciation, and amortization) excluding special items of $290.4 million in 2Q16, a rise of 1.1% from 2Q15. PKG’s capital spending fell by 20.2%, and its cash balance rose by 30.5% between 2Q15 and 2Q16. Next, we’ll look at Ralph Lauren (RL).