Look to This Energy Company for the Best ROE

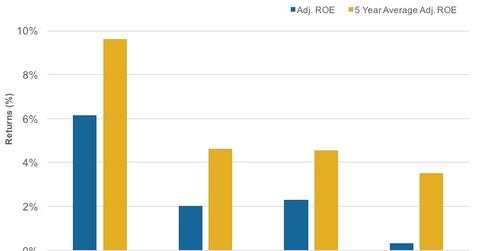

Battered by falling oil prices, the 2Q16 ROE numbers for ExxonMobil (XOM), Chevron, Royal Dutch Shell, and BP were lower than their five-year average historical ROE figures.

Sept. 13 2016, Updated 8:04 a.m. ET

ROE among integrated energy firms

In this part, we’ll look at the ROE[1. return on equity] for four integrated energy firms—ExxonMobil (XOM), Chevron (CVX), Royal Dutch Shell (RDS.A), and BP (BP)—as compared to their five-year average ROE. ROE measures the profit a company generates in comparison to its shareholders’ equity.

Battered by falling oil prices, the 2Q16 ROE numbers for ExxonMobil (XOM), Chevron, Royal Dutch Shell, and BP were lower than their five-year average historical ROE figures. Of these firms, XOM has the highest ROE, standing at 6.1%. On the other hand, BP has the lowest ROE, standing at 0.3%.

Of the other two integrated energy firms, Shell has a better ROE than Chevron. The iShares US Energy ETF (IYE) has an ~42% exposure to integrated energy sector stocks.