Judith Amanda Sourry Knox Joins PVH’s Board of Directors

PVH Corporation (PVH) rose 1.3% to close at $108.60 per share during the third week of September 2016.

Sept. 27 2016, Updated 10:05 a.m. ET

Price movement

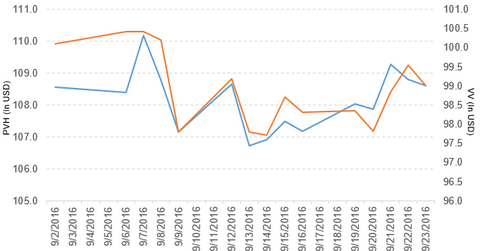

PVH Corporation (PVH) rose 1.3% to close at $108.60 per share during the third week of September 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 1.3%, -0.20%, and 47.6%, respectively, as of September 23, 2016.

PVH is trading 0.48% above its 20-day moving average, 4.4% above its 50-day moving average, and 20.3% above its 200-day moving average.

Related ETF and peers

The Vanguard Large-Cap ETF (VV) invests 0.05% of its holdings in PVH. The ETF tracks a market-cap-weighted index that covers 85% of the market capitalization of the US equity market. The YTD price movement of VV was 7.5% on September 23, 2016.

The market caps of PVH’s competitors are as follows:

Latest news on PVH

Judith Amanda Sourry Knox has been appointed to PVH Corporation’s board of directors, effective December 7, 2016. Knox will be responsible for the board’s compensation committee.

Performance of PVH in fiscal 2Q16

PVH reported fiscal 2Q16 revenue of $1.93 billion, a rise of 3.8% compared to $1.86 billion in fiscal 2Q15. Revenues for its Calvin Klein and Tommy Hilfiger segments rose 12.0% and 6.1%, respectively. Revenue for its Heritage Brands segment fell 14.3% in fiscal 2Q16 compared to fiscal 2Q15.

The company’s gross profit margin and EBIT (earnings before interest and taxes) fell 0.74% and 7.2%, respectively, in fiscal 2Q16 compared to the prior year’s period. Its net income and EPS (earnings per share) fell to $90.5 million and $1.11, respectively, in fiscal 2Q16 compared to $102.2 million and $1.22, respectively, in fiscal 2Q15. It reported non-GAAP (generally accepted accounting principles) EPS of $1.47 in fiscal 2Q16, a rise of 7.3% compared to fiscal 2Q15.

PVH’s cash and cash equivalents and inventories rose 58.9% and 0.68%, respectively, in fiscal 2Q16 compared to fiscal 2Q15. Its debt-to-equity ratio fell to 1.3x in fiscal 2Q16 compared to 1.4x in fiscal 2Q15.

Projections

The company has made the following projections for fiscal 2016:

- revenue growth of 2% on a GAAP basis and 3% on a constant currency basis; revenue for Calvin Klein, Tommy Hilfiger, and Heritage Brands of 5%, 5%, and -8%, respectively, on a GAAP basis

- net interest expense of $117.0 million–$120.0 million

- non-GAAP EPS of $6.55–$6.65, which includes a negative impact related to foreign currency exchange rates of $1.60 per share

- effective tax rate of 20% on a non-GAAP basis

The company has made the following projections for fiscal 3Q16:

- revenue growth of 3% based on a constant currency and GAAP basis

- net interest expense of $30 million

- non-GAAP EPS of $2.35–$2.40, which includes the negative impact of foreign currency exchange rates of $0.45 per share

- effective tax rate of 16%–17%

In the next part, we’ll look at General Mills (GIS).