Investment-Grade Emerging Market Bonds Appear Attractive

Investment-grade emerging market sovereigns have been given BBB or higher credit ratings by one of the credit rating companies. They’re relatively safe.

Sept. 29 2016, Published 11:41 a.m. ET

BUTCHER: There appear to have been fairly strong inflows into emerging markets debt since about February of this year. What’s that about?

RODILOSSO: Some of the improving fundamentals within EM relative to developed markets, e.g., the weaker dollar, have been important factors. Additionally, we’ve seen in 2016 another move lower in developed market rates. Much of what kept people away from EM debt asset classes during the previous two years were concerns about higher rates. You’ve had the Fed going at a slower pace and perhaps no pace at all for the rest of 2016. You’ve had the Brexit. Now you have $11.5 trillion worth of negative-yielding debt in developed markets. You’ve got a huge percentage of the Barclay’s Agg. (Barclays US Aggregate Bond Index) trading below one percent. There are few yield solutions out there for investors.

Emerging markets, now as a longstanding asset class or group of asset classes, particularly the dollar sovereign space, can appear relatively attractive. As a result of some of the declining fundamentals over the previous several years, the emerging markets dollar bond universe that had been as much as 70% investment grade on the sovereign side, suddenly became closer to 50% investment grade. That is what led to some of the thinking around VanEck Vectors™ EM Investment Grade + BB Rated USD Sovereign Bond ETF (IGEM). You’ve seen inflows into dollar sovereigns, local sovereigns, and corporates in emerging markets, and they each offer different risk-reward characteristics. The dollar sovereigns haven’t offered as much yield as local or as corporates, but they have offered lower volatility, particularly in the investment grade space.

Market Realist – Investment-grade emerging market bonds appear attractive.

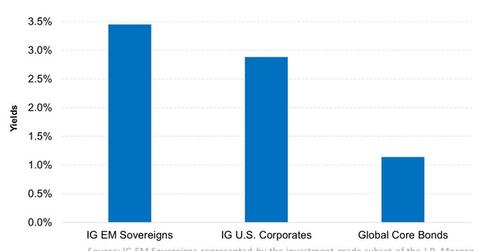

The above graph compares the yields on investment-grade emerging market sovereigns, investment-grade US corporates, and global core bonds.

As you can see, investment-grade emerging market sovereigns offer much higher yields–close to 3.5%–compared to the latter two. Investment-grade emerging market sovereigns have been given BBB or higher credit ratings by one of the credit rating companies. This means that they’re less likely to default and relatively safe. The yields that they’re offering are compelling, especially compared to the direct market debts (BWX).

IGEM also includes BB rated US dollar sovereign bonds. While this part of the ETF isn’t investment-grade, it’s denominated in hard currency, which tends to be less volatile than those denominated in local currencies (EMLC), as the above graph shows.

The graph compares the 30-day volatility of the two, charting annualized standard deviation. The 30-day volatility of the hard currency emerging market bonds stands at 7.2%, while that of local currency emerging market bonds stands at 9.8%. Historically, they have averaged 6.2% and 8.8%, respectively.