Why Ex-Financial Preferreds Offer Competitive Yield Potential

Preferred securities are some of the few investment avenues that still have the potential to provide attractive yields to investors.

Sept. 6 2016, Updated 5:04 p.m. ET

Competitive Yield Potential

Excluding traditional financials from the preferreds universe has not meant giving up the yield potential. An index of non-financial preferreds, as represented by the Wells Fargo® Hybrid and Preferred Securities ex Financials Index yielded 6.1%, as compared to 5.7% from the broad-based Wells Fargo® Hybrid and Preferred Securities Aggregate Index, as of July 31, 2016.[1. Source: FactSet, Wells Fargo, Bloomberg. Data as of July 31, 2016. Based on the Wells Fargo® Hybrid and Preferred Securities Aggregate Index (Preferred Securities, WAGG) and Wells Fargo® Hybrid and Preferred Securities ex Financials Index (Preferred ex Financials, WHPSL). Yields referred to are current yields (ratio of the dividend payment and the security’s current price).]

Market Realist – Ex-financials avoid concentration risk

Preferred securities have the potential to provide attractive yields to investors. Currently, the S&P U.S. Preferred Stock Index yields around 6.1%, much higher than the S&P 500 Index with a yield of 2.1%. Even yields on other asset classes pale in comparison to yields on preferreds. Emerging market bonds yield 4.3%, high-dividend stocks yield 3.2%, and corporate bonds yield around 3%.

The higher yield from preferreds is not necessarily due to the influence of traditional financial firms. Excluding financials, the yield on preferreds isn’t affected drastically. Rather, it’s higher when financials face a slowdown. Ex-financial preferreds avoid concentration risk and help with portfolio diversification.

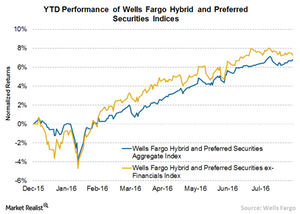

While the yield for ex-financials preferreds (PFXF) is higher, occasionally returns are also higher than the all-inclusive index. The Wells Fargo Hybrid and Preferred Securities ex Financials Index (PSK) tracks the overall performance of publicly traded preferred securities, excluding financials (XLF). The index is up 7.3% year-to-date. Preferred securities (PFF) include convertible securities, depository preferred securities, and perpetual subordinated debt. On the other hand, the Wells Fargo Hybrid and Preferred Securities Aggregate Index, which tracks the overall performance of publicly traded preferred (PGX) securities, including financials, is up 6.8% year-to-date.