Ex-Financial Preferreds’ Attractive Risk-to-Return Trade-Off

Financials (XLF) have a heavy concentration in preferred securities. Consequently, financials have a significant influence on returns.

Sept. 6 2016, Updated 7:04 p.m. ET

Attractive Risk/Return Tradeoff

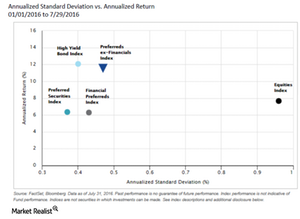

While the impact on yield has been negligible, the two-thirds concentration in financial preferreds has had a significant influence on returns. This concentration may not always be a negative factor, but is one worth considering. For example, the 2008/2009 credit crisis clearly showed the market that when financials sell off, they can do so significantly. In addition, excluding traditional financials allows for greater participation in other sectors, such as energy, utilities, and consumer staples. As shown in the chart below, avoiding financial preferreds contributed to over 5% outperformance year to date.[1. Source: FactSet. Data as of July 31, 2016. Based on 6.4% and 11.5% year to date performance from the Wells Fargo® Hybrid and Preferred Securities Aggregate Index (Preferred Securities, WAGG) and Wells Fargo® Hybrid and Preferred Securities ex Financials Index (Preferred ex Financials, WHPSL), respectively.]

Market Realist – Ex-financials provide diversification benefits

As we mentioned in the previous part of this series, financials (XLF) have a heavy concentration in preferred securities. Consequently, financials have a significant influence on returns. During the financial crisis, the S&P U.S. Preferred Stock Index lost 12.2% in 2007 while posting additional 25.8% losses in 2008. The sharp fall was mainly triggered by a downturn in banks and financial companies, which have a dominant weight in preferred securities.

Like bonds, preferred (PFF) securities are also sensitive to interest rate changes. A sharp rise in interest rates normally hurts preferred (PGX) stocks because of a fall in value to compensate for a better rate. The opposite is true during a falling rate scenario. On the other hand, gradual rate increases would benefit traditional financials and banks that issue preferreds by improving their net interest margins.

Since the financial crisis of 2008, the case for preferreds (PSK) has been bolstered on the back of strict regulations that needed banks to shore up their capital bases and curtail riskier activities. These measures aimed at strengthening banks’ balance sheets and also helped provide secure payments to preferred stockholders.

Ex-financial preferred securities avoid concentration risk. As we mentioned earlier, more than 80% of preferreds are issued by financial firms. Any slowdown in the financial sector could drastically affect returns from all-inclusive preferreds. In this kind of scenario, ex-financial preferreds (PFXF) seems to be the better option, as they help take on more exposure to diversified sectors like telecom, energy, healthcare, industrials, and consumer staples.