Does Brazil’s Industrial Production Data and Selic Rate Ring a Bell?

First the good news: After two years of a deep recession, the economic fundamentals of Brazil are showing signs of bottoming out. Industrial production has started to turn, and so have sentiment indicators, with business confidence indexes leading the way (source: Bloomberg). Particularly encouraging are the improvements in the inflation trend. Prices have been easing […]

Sept. 13 2016, Updated 2:24 p.m. ET

First the good news: After two years of a deep recession, the economic fundamentals of Brazil are showing signs of bottoming out. Industrial production has started to turn, and so have sentiment indicators, with business confidence indexes leading the way (source: Bloomberg).

Particularly encouraging are the improvements in the inflation trend. Prices have been easing since early 2016 (source: Bloomberg), and the new central bank committee’s focus on bringing down inflation has also helped lower inflation expectations for the year ahead. This ongoing adjustment has raised expectations of monetary policy easing, namely interest rate cuts in the fourth quarter, which will be supportive of a recovery in economic activity.

Market Realist – Growth in Brazil’s industrial production

Brazil’s industrial production grew 0.1% in July 2016 compared to June 2016. The country’s industrial production beat the market estimate of a 0.2% dip with posted growth of 1.3%. Brazil marked the fifth successive month of increased industrial output, driven by mining, computer equipment, electronic and optical products, metallurgy, coke, oil products and biofuels, rubber products and plastics, and food. Brazil has recorded average industrial production of 0.14% from 1985 until 2016. The industrial production has ranged between 5% and -5% growth since 2010.

However, industrial production dipped 6.6% on a year-over-year basis in July 2016 compared to a 5.8% dip in June 2016. The industrial sector has fallen by 8.7% since the beginning of 2016 with a decline of 13.5% in production. The country had an average industrial production of 1.9% between 1976 and 2016.

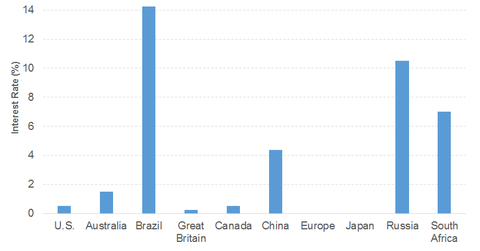

Brazil’s intact Selic rate

The central bank of Brazil kept its benchmark interest rate, or the Selic rate, intact at 14.3% on August 31, 2016. This is the highest compared to the rest of the world. The country’s Selic rate had averaged 15.7% between 1999 and 2016, slumping to a minimum level of 7.3% in October 2012.

Interest rates have been unchanged since July 2015 to attract investors in an attempt to tackle the slowing GDP and the rising consumer prices. There were also speculations about monetary stimulus to rescue Brazil from the fangs of a slowdown. The interest rates and the possibility of monetary stimulus have had a very positive impact on Brazil’s currency despite the dwindling Latin American economy.

Brazil’s rising consumer prices

Brazil’s consumer prices grew 8.7% on a year-over-year basis in July 2016 compared to 8.8% in June 2016. The 8% mark was breached for the first time in the last ten years between March and April 2015, and it crossed the 10% mark in October 2015. The sharp increase was mainly driven by prices for housing and furnishing, food and beverages, transportation, health, education, and recreation activities.

Prices started cooling down beginning in January 2016 and are gradually trying to stabilize below the 9% mark. This was driven by the drop in housing costs, offset by food and transportation. The central bank is expecting inflation of 7.3% in fiscal 2016, which is above its target of 4.5%. The IMF expects consumer prices in the emerging markets and developing economies to grow 4.6% in 2016 compared to 4.7% in 2015. The consumer prices are expected to dip marginally to 4.4% in 2017.

Brazil’s temporary relief from the Fed

Brexit fears dissuaded the US Fed from hiking interest rates for the time being. As a result, Brazil got temporary solace, thereby rendering US bonds more attractive than the Brazilian bonds and overburdening Brazil with a higher level of dollar-denominated debt. The Deutsche X-trackers MSCI Brazil Hedged Equity ETF (DBBR) has generated a 26-week return of 18.3%.

Concerns over China’s slowdown

According to the IMF, China accounts for 15%–25% of the exports of Brazil, Chile, Peru, Uruguay, and Venezuela. Therefore, a slowdown in China will have a further negative impact on the already declining commodity prices. This is bound to take a toll on the commodity-driven economies. The First Trust Latin America AlphaDEX Fund (FLN) generated a YTD return of 45.4%.