Why the Bank of Japan Wants to Overshoot Its Inflation Commitment

One of the key features of Japan’s new monetary policy framework is its inflation-overshooting commitment.

Sept. 29 2016, Updated 2:04 p.m. ET

New commitment on inflation target

One of the key features of Japan’s new monetary policy framework is its inflation-overshooting commitment. The Bank of Japan intends to expand its monetary base until inflation goes above its price stability target of 2%. Unlike before, there’s no time frame for inflation to move to that level.

In his speech to business leaders in Osaka on September 26, 2016, Haruhiko Kuroda, governor of the Bank of Japan, was quick to point out that this shouldn’t be considered an increase in the country’s price stability target. What this commitment means, he said, is that observed inflation should be around 2% over a business cycle, implying that there can be times when inflation is above 2%.

A backward-looking commitment

Monetary policy is conducted in a forward-looking manner due to the time lag between the policy announcement and its impact. However, the Bank of Japan’s inflation-overshooting commitment is based on observed instead of forward-looking inflation, thus becoming backward-looking.

As we saw in Part 4 of this series, the people of Japan negotiate wages and make their investments based on observed instead of expected inflation. A prolonged period of deflation has led them to do that. So the Bank of Japan intends to use actual instead of projected inflation to meet its inflation-overshooting commitment.

Monetary base increase

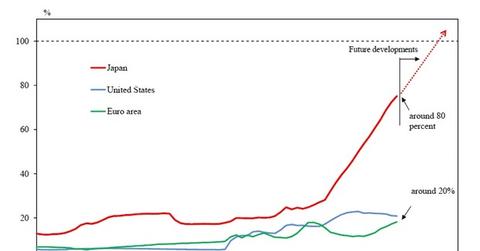

Kuroda also said that Japan’s monetary base, as shown in the above graph, stands at 400 trillion yen, or 80% of the nominal GDP. He added that going forward, “the ratio is calculated to exceed 100 percent in slightly over one year, assuming that the Bank will continue with the current pace of increase in the monetary base.”

He said further that we should not be concerned about runaway inflation due to a tightening of the monetary policy behind the curve. This is so because this bold step in increasing the monetary base is necessary to jolt the economy and prices. According to Kuroda, even if inflation were to accelerate past the 2% mark, which he doesn’t consider very likely, due to the yield curve control framework, the Bank of Japan can bring inflation back to its price stability target of 2%.

By adopting this policy, the Bank of Japan has shown that it’s committed to removing the deflationary mindset and that it will remain accommodative in the long haul, far beyond what was expected earlier. It remains to be seen whether consumers will react positively to this. If they do, it could help consumer-focused companies (CAJ) (HMC) (TM) along the way, and international investors could be attracted to Japanese investments (DXJ) (HEWJ) once again.