What Are Analysts’ Recommendations for H.B. Fuller?

About 66% of the brokerage firms covering FUL stock have recommended a “buy,” 34% have recommended a “hold,” and none have recommended a “sell.”

Sept. 29 2016, Updated 10:04 a.m. ET

Analysts’ recommendations

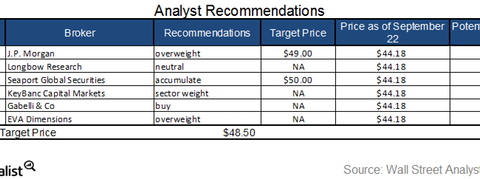

As of September 22, 2016, H.B. Fuller’s (FUL) consensus 12-month target price was $48.50. That price indicates a return potential of 9.8% from its closing price of $44.18 on September 22.

There are six brokerage firms actively tracking FUL stock. About 66% of them have recommended a “buy” for the stock, 34% have recommended a “hold,” and none have recommended a “sell.”

Key recommendations for H.B. Fuller

Only two brokerage firms have recommended a price target for H.B. Fuller after the company announced its 3Q16 earnings on September 22, 2016.

- On September 23, 2016, JPMorgan Chase (JPM) gave H.B. Fuller an “overweight” rating with a price target of $49, implying a 12-month potential return of 10.9% over the closing price of $44.18 on September 22.

- On September 23, Seaport Global Securities gave an “accumulate” rating to H.B. Fuller with a price target of $50, implying a 12-month potential target return of 13.2% over the closing price of $44.18 on September 22.

- On September 23, Longbow Research gave H.B. Fuller a “neutral” rating but didn’t provide any price target.

As of September 22, the ProShares Russell 2000 Dividend Growers ETF (SMDV) had 1.6% of its total holdings in H.B. Fuller. A few holdings of this ETF include G&K Services (GK) and Community Bank System (CBU), with weights of 2.1% and 1.9%, respectively.