UPS: Decoding Its Domestic Segment’s Q3 Revenue Growth

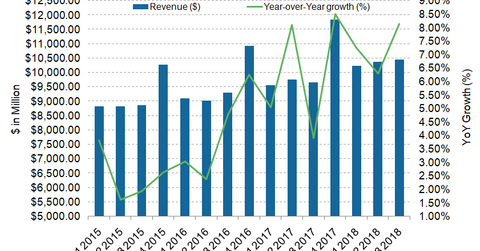

In the third quarter, the US Domestic Package segment’s revenues jumped 8.1% YoY to $10.4 billion from $9.6 billion in the third quarter of 2017.

Oct. 29 2018, Updated 10:31 a.m. ET

US Domestic Package’s Q3 revenues

Previously in this series, we looked at United Parcel Service’s (UPS) revenues and its growth in the third quarter. Here, we’ll review the company’s segmental results, starting with its US Domestic Package segment.

This segment is the biggest contributor to UPS’s revenues, accounting for an ~60.0% share. In the third quarter, the US Domestic Package segment’s revenues jumped 8.1% YoY (year-over-year) to $10.4 billion from $9.6 billion in the third quarter of 2017.

Service yields and volumes

The US Domestic Package segment comprises UPS Next Day Air, UPS Deferred, and UPS Ground services. UPS Next Day Air’s revenues jumped 7.2% to ~$1.9 billion in the third quarter from $1.7 billion in the same period last year.

Next Day Air’s average daily package volume rose 3.7% to 1.5 million in the third quarter from 1.4 million in the third quarter of 2017. Its average revenue per piece rose 3.3% to $19.72 in the third quarter from $19.09 in the third quarter of 2017.

UPS Deferred’s revenues rose 6.5% to $1.06 billion in the third quarter from $1.0 billion in the third quarter of 2017. Its revenue growth was driven by a 5.2% YoY increase in its average revenue per piece. UPS Deferred’s average daily package volume growth was 1.3% YoY in the third quarter of 2017.

UPS Ground contributed 71.6% to the US Domestic Package segment’s revenues in the third quarter. UPS Ground’s third-quarter revenues jumped 8.6% to $7.4 billion from $6.8 billion in the third quarter last year.

UPS Ground’s average daily package volume grew 3.4% YoY to 13.6 million in the third quarter from ~13.2 million in the third quarter of 2017. Ground’s average revenue per piece rose 5.1% YoY to $8.71 in the third quarter from $8.29 in the third quarter of 2017.

Management’s outlook

In the US Domestic Package segment, UPS expects to have a good peak season in 2018 despite one less operating day and the planned startup costs for multiple large facilities. UPS guided for additional revenue management and pricing initiatives in the US Domestic segment. The company expects to invest in the extensive upgrade to its US network, adding a record amount of new highly automated capacity within this network.

ETF investment

Investors who are bullish on transportation and logistics companies can consider investing in the iShares Transportation Average ETF (IYT). United Parcel Service’s Class B stock makes up 7.11% of IYT’s holdings. The ETF’s top holdings comprise FedEx (FDX) with 13.96% weight, Norfolk Southern (NSC) with 11.04% weight, and Union Pacific (UNP) with 9.25% weight.

We’ll review the performance of UPS’s International Package segment in the next article.