Quality May Provide Attractive Risk-Adjusted Returns

It’s useful to analyze the historical returns of credit rating categories within emerging markets bonds.

Sept. 1 2020, Updated 12:18 p.m. ET

It is also useful to analyze the historical returns of the different credit rating categories within emerging markets bonds. Historical returns incorporate the market’s assessment of changes in credit quality, which can often precede changes in a country’s credit rating.

As shown in the table below, the higher quality categories generally exhibited lower annualized total returns over the past ten years, with substantially lower volatility. One notable exception is the BB-rated category which outperformed B-rated bonds, providing risk adjusted returns comparable to A-rated bonds.[1. source: JP Morgan and Morningstar as of July 31, 2016]

Overall, investors who maintained exposure to investment grade emerging markets sovereign bonds, with an allocation to BB-rated bonds or 20%, would have earned 7.55% over the past ten years versus 7.83% on the broader emerging markets sovereign index, with lower volatility and higher risk-adjusted returns as measured by the Sharpe ratio.

For investors seeking to enhance yield while balancing risks, a focus on high quality emerging markets sovereign bonds may be an attractive addition to a bond portfolio. VanEck VectorsTM EM Investment Grade + BB Rated USD Sovereign Bond ETF (IGEM) provides access to the higher rated subset of the broad U.S. dollar-denominated emerging markets sovereign bond universe.

Market Realist – What to do in a yield-starved world

In this yield-starved world, investors may want to consider augmenting their bond portfolios with EM (emerging market) bonds (VWOB) (EMB). Their higher yields, larger credit spreads, exposure to economic growth of emerging countries, and attractive duration profiles are only some of the reasons investors might consider investing in EM debt.

As we’ve already seen, investors seeking both yield and safety can look to the VanEck Vectors EM Investment Grade + BB Rated USD Sovereign Bond ETF (IGEM). The ETF seeks to replicate returns from the JP Morgan Custom EM Investment Grade Plus BB-Rated Sovereign USD Bond Index, which is comprised primarily of investment-grade US dollar–denominated bonds issued by EM governments.[1. source: Van Eck]

IGEM has total net assets worth $15.1 million, a 30-day SEC (U.S. Securities and Exchange Commission) yield of 3.1%, a yield to maturity of 3.4%, and an effective duration of 8.2 years.

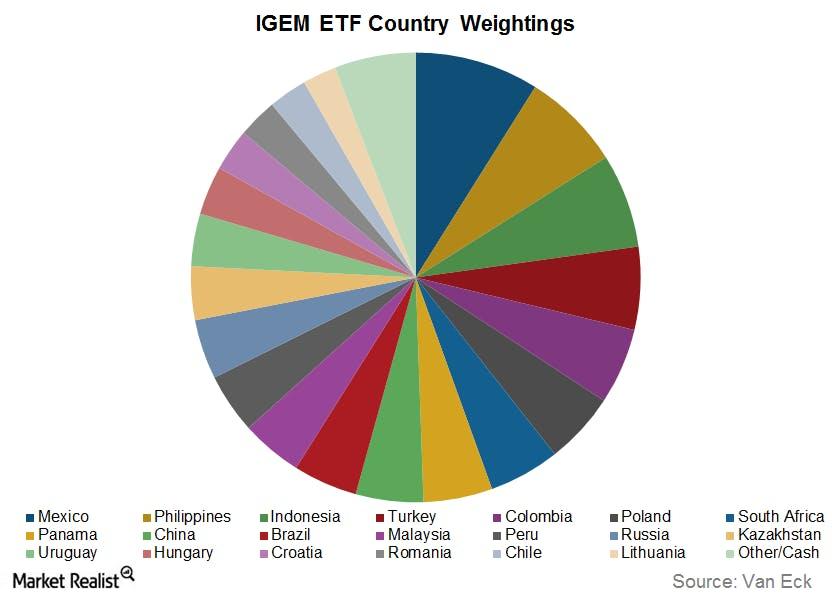

The above graph shows the country weightings for IGEM. The top countries by weight include Mexico at 8.9%, the Philippines at 7.1%, Indonesia at 6.8%, Turkey at 5.9%, and Colombia at 5.5%. China (FXI) (ASHR), Brazil (EWZ), and Russia (RSX) constitute 4.9%, 4.6%, and 4.3% of the ETF, respectively.

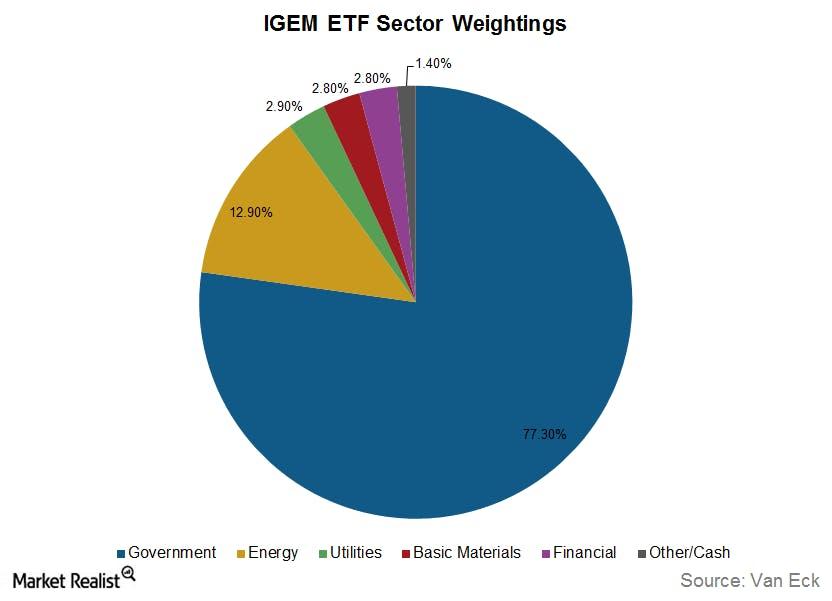

The above graph shows the sector breakdown of IGEM.

About 78.8% of IGEM is comprised of investment-grade-rated assets (AA: 2.8%, A: 16.8%, BBB: 59.2%), while 19.8% of the ETF is comprised of BB rated assets. So the credit quality of IGEM looks robust.

Investors looking to invest in high-yield EM bonds can look to the VanEck Vectors Emerging Markets High Yield Bond ETF (HYEM). Investors looking to invest in aggregate EM bonds can look to the VanEck Vectors Emerging Markets Aggregate Bond ETF (EMAG) and the VanEck Vectors JP Morgan EM Local Currency Bond ETF (EMLC).