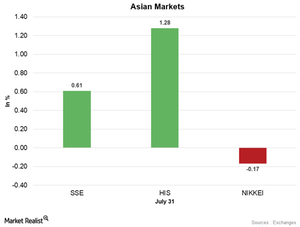

Asian Markets Started This Week on a Positive Note

After gaining for six consecutive trading weeks, China’s Shanghai Composite Index started this week on a stronger note.

Aug. 1 2017, Updated 7:43 a.m. ET

Economic calendar

10:00 AM EST – US pending home sales (June)

9:45 PM EST – China’s Caixin manufacturing PMI (purchasing managers’ index) (July)

China

After gaining for six consecutive trading weeks, China’s Shanghai Composite Index started this week on a stronger note. Last week, the market sentiment was mixed amid profit-booking, regulatory concerns, and optimism about China’s economic stability in 2H17.

The market regained strength this week amid supporting manufacturing and services PMI data. According to the data released by the China Logistics Information Centre, the manufacturing PMI fell from 51.7 in June to 51.4 in July. The services PMI fell from 54.9 in June to 54.5 in July. Despite a brief pullback, the PMI numbers are strong considering that a reading above 50 indicates growth during the reported period. The market is looking forward to the release of the Caixin manufacturing and services PMI that are scheduled to release this week.

On July 31, the Shanghai Composite Index rose 0.61% and ended the day at 3,273.03. The SPDR S&P China ETF (GXC) rose 0.64% to $96.37 on July 28.

Hong Kong

After gaining for three consecutive trading weeks, Hong Kong’s Hang Seng Index opened this week on a stronger note. It opened higher on Monday and rose to the highest levels in 25 months. The weaker dollar and increased expectations on supply-side reforms in China are supporting the Hang Seng Index. The expectations of an increased fund flow into Hong Kong from China, amid optimism about China’s economic stability in 2H17, are supporting the market rally. The Hang Seng Index rose 1.3% and closed the day at 27,323.99. The iShares MSCI Hong Kong ETF (EWH) rose 0.46% to $24.17 on July 28.

Japan

After falling for two consecutive trading weeks, Japan’s Nikkei Index started this week on a weaker note. Nikkei opened lower on Monday and closed the day at the lowest levels in three weeks. Despite supporting second quarter earnings by Nikkei components, the index pulled back due to weakness in index heavyweights Fanuc and Softbank. Nikkei fell 0.17% and closed the day at 19,925.18.

In the next part, we’ll discuss how European markets performed in the morning session on July 31.