A Look at Zimmer Biomet’s Latest Valuation

After the release of its 2Q16 earnings results on July 28, 2016, Zimmer Biomet Holdings (ZBH) was trading at a forward price-to-earnings multiple in the range of 15.5x–16.2x.

Aug. 16 2016, Updated 9:05 a.m. ET

Valuation multiples

After the release of its 2Q16 earnings results on July 28, 2016, Zimmer Biomet Holdings (ZBH) was trading at a forward PE (price-to-earnings) multiple in the range of 15.5x–16.2x. Forward PE measures the company’s growth and is calculated by dividing its stock price by the earnings estimate for the next 12 months.

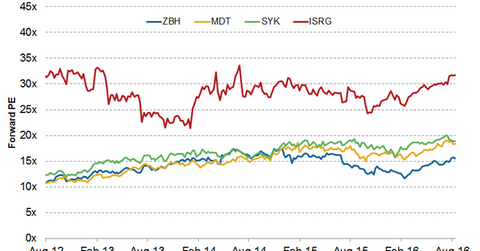

On August 12, 2016, Zimmer Biomet Holdings was trading at a forward PE of 16.2x, lower than its peers Medtronic (MDT), Intuitive Surgical (ISRG), and Stryker (SYK). The above graph compares the forward PE of Zimmer Biomet Holdings and its peers.

Investors interested in diversified exposure to Zimmer Biomet Holdings can consider the iShares Russell Mid-Cap Value ETF (IWS). ZBH accounts for ~0.34% of IWS’s total holdings.

Zimmer Biomet Holdings has an attractive product portfolio, strong revenues, leading market position, and geographic presence. However, the company has low leverage ratio due to the costs of large-scale acquisition of Biomet and several bolt-on acquisitions in the previous year. Also, the company’s negative earnings pose a concern.

Zimmer Biomet Holdings’s share price movement

Zimmer Biomet Holdings’s stock was trading at $129.50 on August 11, 2016. It has a 50-day moving average of $123.2 and a 200-day moving average of $109.7. On August 9, 2016, Zimmer Biomet Holdings was trading at a 52-week high of $133.2. On the same day, Zimmer Biomet Holdings launched its secondary offering of its common stocks. The stock was trading at a 52-week low of $88.30 on February 12, 2016.

The company’s share price rose by ~2.8% after the release of its 2Q16 earnings on July 28, 2016. The rise in its stock price was triggered by strong revenue growth and the higher-than-expected integration synergies reported by the company.