A Look at Expedia’s Valuation: How Does It Compare?

Expedia (EXPE) currently trades at a forward PE (price-to-earnings) multiple of 20x.

Aug. 5 2016, Updated 11:04 a.m. ET

Current valuation

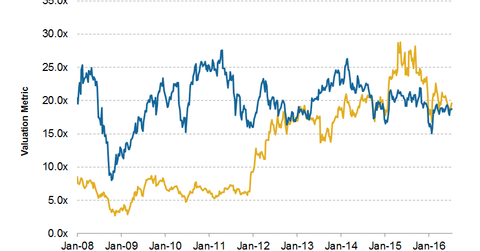

Expedia (EXPE) currently trades at a forward PE (price-to-earnings) multiple of 20x. Expedia’s valuation multiple is significantly higher than the average of its valuation multiples since November 2008, which stands at 13x. It is also higher than rival Priceline’s (PCLN) forward PE multiple of 19x. However, it is lower than TripAdvisor’s (TRIP) 35x and Ctrip.com’s (CTRP) 58x. However, TripAdvisor and Ctrip.com are not strictly comparable.

The market is expecting EXPE’s EPS (earnings per share) to grow by 33% in 2016. Rival PCLN’s EPS are expected to grow at a much slower rate, by 14%. As shown in the chart above, EXPE has mostly traded below Priceline (PCLN) since 2008.

Our analysis

Valuation multiples help us understand the market’s perception of risk, growth, and investors’ willingness to pay. Investors seem to be optimistic about Expedia’s future growth.

A growing travel demand in the long term will drive growth for online travel agencies. Lower airfares and growing consumer disposable income will be positive for the industry, despite the uncertainty brewing.

However, increasing competition will keep Expedia’s growth in check. Also, the terror attacks will add to increasing uncertainty. Investors should keep an eye on EXPE’s leverage, as a higher leverage will make the stock more volatile. EXPE forms ~1.3% of the S&P 500 Pure Growth ETF (RPG).