Is Danaher Losing Its Competitive Advantage?

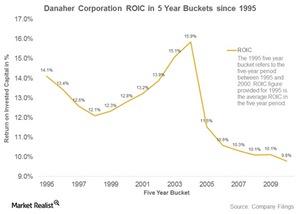

We analyzed Danaher’s (DHR) ROIC in the 20-year period between 1995 and 2015 and classified the period of study into 16 buckets of five years each.

Aug. 19 2016, Updated 9:05 a.m. ET

Importance of ROIC

It’s not hard to see why ROIC (return on invested capital) has become an important metric in the investment community. Businesses raise capital from debt and equity investors, and they invest this capital in operations that they expect will make more money than the cost paid to borrow it.

If a company’s operations fail to generate the cost of capital in future years, would investors be willing to bet their money on it? Of course not.

As recently as March 2015, automotive (XLY) manufacturer General Motors (GM) came under pressure from activist investors for having an unsatisfactory ROIC. The automaker (FSAVX) eventually bowed to the demands made by these investors by gearing its incentive compensation plan to ROIC and targeting a goal of maintaining an average ROIC of 20%.

Why is ROIC used as a metric for measuring competitive advantage?

The association of ROIC with a competitive advantage can be understood by breaking ROIC down into its components. ROIC is reached by dividing after-tax operating profits by invested capital. Invested capital is arrived at by subtracting cash and cash equivalents from the sum of debt and equity.

For the same amount of invested capital, a company with high ROIC must have high operating margins, and high operating margins can be derived only by creating sustainable barriers that prevent price-based competition.

Barriers could be high switching costs for customers, as is the case for Microsoft’s (MSFT) Windows-based operating system, or intellectual property rights that protect innovative products from duplication. These barriers enable companies to charge premiums for their products, bumping their operating margins and by extension their ROICs.

Danaher’s ROIC trend

We analyzed Danaher’s (DHR) ROIC in the 20-year period between 1995 and 2015 and classified the period of study into 16 buckets of five years each. For example, the first bucket was 1995-2000, the second bucket was 1996-2001, and so on.

As seen above, Danaher’s average five-year ROIC has registered consecutive falls since the 2004–2009 bucket. Therefore, we can conclude that Danaher has found fewer and fewer reinvestment opportunities to match its high returns in 2006.

In the next part in this series, we’ll continue this analysis by comparing Danaher with the healthcare equipment industry.