Investing in Restaurant Stocks: Tailwinds and Challenges

You could consider investing in restaurant stocks, given the solid fundamentals in the sector and the macroeconomic tailwinds favoring the industry.

Nov. 20 2020, Updated 12:18 p.m. ET

Solid fundamentals

You may consider investing in restaurant stocks, given the solid fundamentals in the sector and the macroeconomic tailwinds favoring the industry.

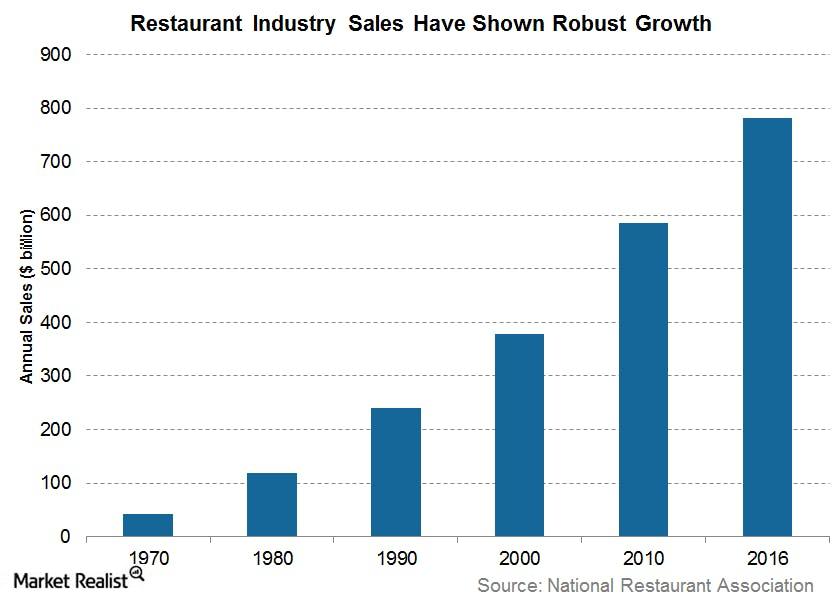

- As shown in the graph above, total restaurant industry sales have increased from $379 billion in 2000 to $586.7 billion in 2010. In 2016, sales are projected to cross a whopping $782.7 billion.

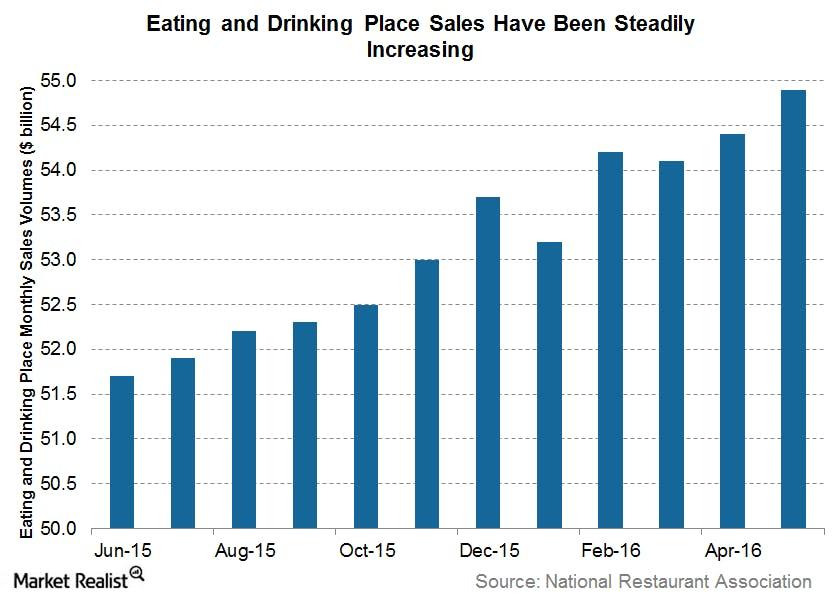

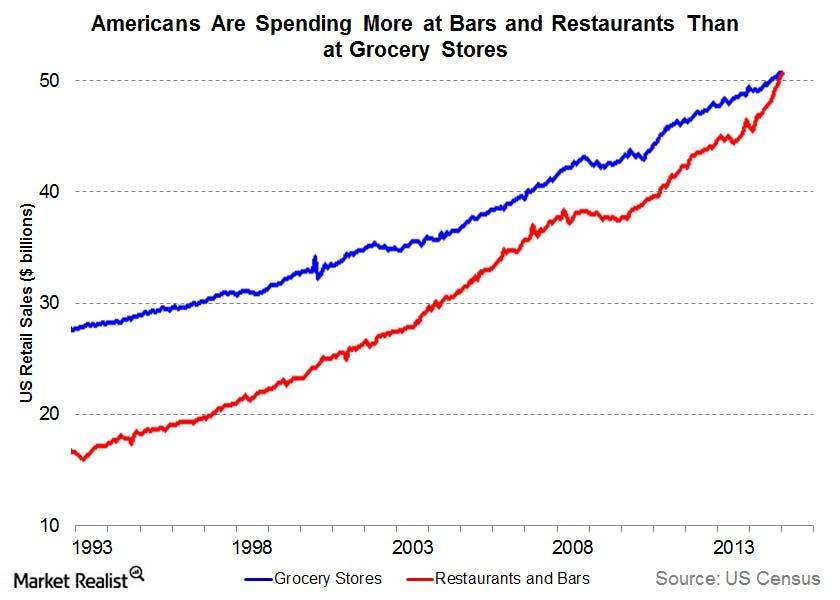

- Consumers’ spending habits are changing. More and more Americans prefer to eat out than to cook at home. This March, for the first time in recorded history, US spending on restaurants surpassed spending at grocery stores, as demonstrated in the graph above. According to the US Census, over the past year, Americans spent $54.8 billion at bars and restaurants versus $52.5 billion on groceries (Source: US Census). This trend could be due to a broad demographic shift. With women taking over a larger share of the total workforce in the past few decades, the way that households eat has also seen a change. In addition, the millennial generation has proved that their spending habits are skewed away from eating at home. According to data from Boston Consulting Group, millennials prefer to eat out 3.4 times a week, whereas non-millennials eat out 2.8 times a week. The share of food away from home as a percentage of total household food expenditure has risen from 25.9% in 1970 to 43.1% in 2012 (Sources: USDA, Quartz).

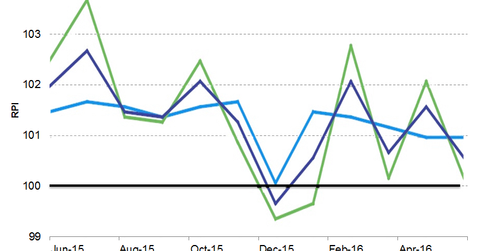

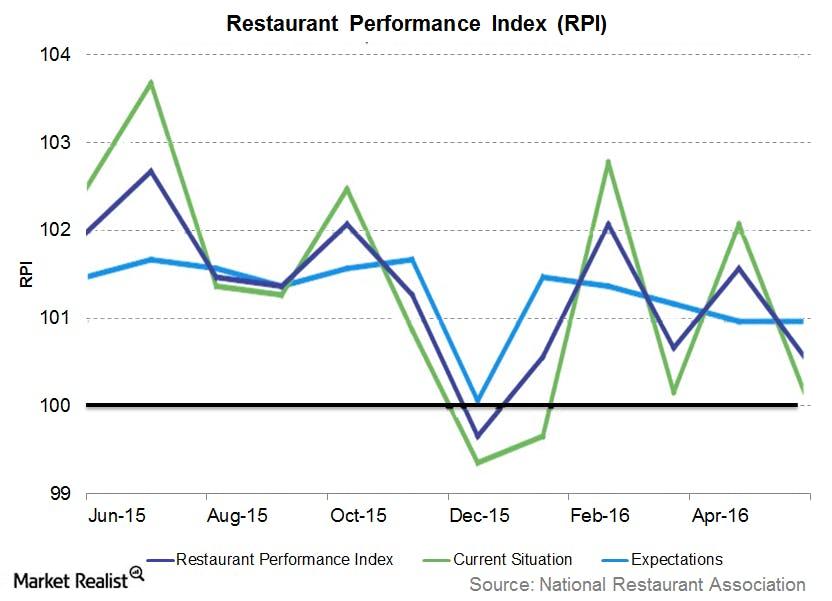

- The Restaurant Performance Index, or RPI, was in expansionary territory at 100.6 in May 2016, though it was down 0.9% from the last month. The Current Situation Index stood at 100.2 in May, down 1.8% from April, while the Expectations Index stood unchanged at 101. Although restaurant indicators trended somewhat downward in May, the indices stand above 100, indicating expansion. The outlook for the coming months generally looks positive.

- As we discussed in the previous parts of this series, low oil prices are both helping the discretionary sector (XLY)(XLP) in general and the restaurant sector in particular.

- However, investors should be cautious about certain challenges restaurant stocks might face, such as high labor costs, an unfavorable currency impact due to the recent Brexit vote, and weakness in the Chinese economy. To learn more about how restaurant stocks reacted to the news of the Brexit vote, read our series How Restaurant Stocks Are Reacting to the Brexit Vote.

We believe that the restaurant sector would continue to hold its own in the year ahead. Investors should look to the Restaurant ETF (BITE) to capitalize on the gains presented by the sector. The next part of this series will tell you all you need to know about the ETF.