Does Emerson Have a Competitive Advantage?

An analysis of Emerson Electric’s (EMR) ROIC between 1995 and 2015 shows that 2001–2003 were the only years when ROIC fell below 13%.

Aug. 24 2016, Published 11:30 a.m. ET

Importance of ROIC

It’s not hard to see why ROIC (return on invested capital) has become an important metric in the investment community. Businesses raise capital from debt and equity investors, investing this capital in operations that they expect will make more money than the cost paid to borrow it.

If a company’s operations fail to generate the cost of capital in the future, would investors be willing to bet their money on it? Of course not. As recently as March 2015, automotive (XLY) manufacturer General Motors (GM) came under pressure from activist investors for having unsatisfactory ROIC. The automaker eventually bowed to the demands made by these investors by gearing its incentive compensation plan to ROIC and targeting a goal of maintaining an average ROIC of 20%.

Why is ROIC used as a metric for measuring competitive advantage?

The association of ROIC with competitive advantage can be understood by breaking ROIC down into its components. ROIC is reached by dividing after-tax operating profits by invested capital. Invested capital is arrived at by subtracting cash and cash equivalents from the sum of debt and equity. For the same amount of invested capital, a company with high ROIC must have high operating margins. High operating margins can be derived only by creating sustainable barriers that prevent price-based competition.

Barriers could be high for switching costs for customers, which is the case for the Microsoft (MSFT) Windows operating system. It could also be high for intellectual property rights that protect innovative products from duplication. These barriers enable companies to charge premiums for their products, bumping their operating margins and, by extension, their ROICs.

20-year analysis of Emerson Electric’s ROIC

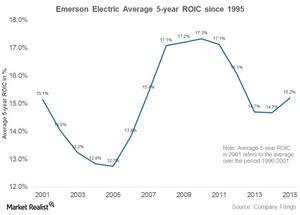

An analysis of Emerson Electric’s (EMR) ROIC between 1995 and 2015 shows that 2001, 2002, and 2003 were the only years when ROIC fell below 13%. The average ROIC over the 20-year period was 15.3%.

Upon classifying the data into 16 buckets of five years each (for example, 1996–2000, 1997–2001, and so on), we found that the average five-year ROIC every year has generally hovered around 15%. The average five-year ROIC in the 2011–2015 period was 15.2%.

Since Emerson has managed to maintain its ROIC at elevated levels for a reasonably long period of time, it does seem like the company has a competitive advantage.

In the next part of this series, we’ll continue our returns analysis of Emerson by comparing it with electrical equipment (IYJ) peers. We’ll also see why we feel Emerson has a competitive advantage.