Emerging Market Bonds: Higher Yields Could Reflect Higher Risks

Emerging market bonds have been doing extremely well over the past couple of months. EM debt funds have been in the green for seven consecutive weeks.

Aug. 23 2016, Updated 2:04 p.m. ET

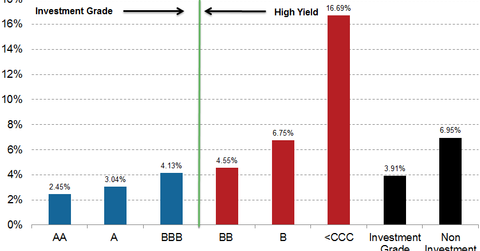

From a yield perspective, lower rated bonds tend to provide higher yields versus those with higher ratings. This should not be surprising since a higher yield is reflective of a higher spread which incorporates, among other factors, a higher risk of default. As shown in the chart below, investment grade emerging markets bonds had an average yield of 3.91% as of July 31, 2016 compared to a yield of 6.95% on bonds with high yield ratings. Breaking that down further, it’s clear that the yield pickup becomes increasingly large between the BB-rated and B-rated categories.

Market Realist – Why EM bonds have been doing so well

EM (emerging market) bonds (EMB) (EMAG) have been doing extremely well over the past couple of months. According to Bank of America Merrill Lynch’s weekly Flow Show report, ~$2 billion flowed into EM debt funds in the past week. The report also shows that EM debt funds have been in the green for seven consecutive weeks. During that time, more than a record $20 billion has been invested in EM bonds.[1. source: Barrons]

The above graph from Bank of America Merrill Lynch shows the weekly FICC (Fixed Income Clearing Corporation) flows as a percentage of AUM (assets under management) for various asset classes. EM bonds have been flourishing.

As we’ve already seen, not all EM bonds are built equally. Higher yields may mean lower credit ratings and thus higher risks. You should also note that different countries could mean different risk profiles for EM debt. The above graph shows the regional breakdown of global emerging market debt.

Investors probably shouldn’t just consider EM sovereign debt (VWOB) (PCY) as a possible investment. The EM corporate debt market (IGEM) could also be a good opportunity.

The EM corporate market has grown at a compound annualized rate of 30% since 2006. It’s largely diversified over 60 countries and more than 1,000 corporate issuers.[2. source: T.Rowe Price Insights]

According to Jane Brauer of Bank of America, in 2015, the total value of the global emerging market outstanding rose by $2 trillion on a year-over-year basis to $18.2 trillion. This represents a huge increase of 24% in local currency terms and 12% in US dollar terms.

More than 60% of the EM corporate debt market is considered investment grade. In fact, only 2% is rated below CCC.[3. source: T.Rowe, Barrons] So credit quality is in favor of EM corporate bonds. Also, EM bonds tend to give larger credit spreads compared to their developed market counterparts.

We believe that growth in the EM corporate debt market is organic and sustainable and thus could be a good opportunity for investors.

In the next part of the series, we’ll explore the negatives of investing now in EM bonds.