Did China End Its 4-Month Decline in Foreign Reserves in March?

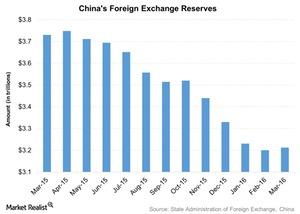

China’s State Administration of Foreign Exchange, or SAFE, released foreign reserve data for March on April 7, 2016. China’s foreign reserves rose $10.3 billion to $3.2 trillion in March.

Aug. 18 2020, Updated 6:34 a.m. ET

China’s foreign reserves rose

China’s State Administration of Foreign Exchange, or SAFE, released foreign reserve data for March on April 7, 2016. China’s foreign reserves rose $10.3 billion to $3.2 trillion in March. The rise in reserves indicates that the Chinese government’s monetary easing partly helped to curb the heavy capital flows.

The rise in foreign reserves is partly attributed to the recent weakening of the dollar after the Federal Reserve presented a dovish outlook about a future rate hike. It is also believed that the People’s Bank of China, or PBoC, has been using derivatives to prop up the yuan. The advantage of derivatives transactions is that the PBOC doesn’t have to physically sell its foreign currency reserves to support the yuan. According to data released by the PBoC last week, the central bank held $28.9 billion of “short” derivatives positions at the end of February. These represent future claims on its foreign exchange reserves.

China witnessed a sharp decline in foreign reserves after the PBoC had devalued the yuan in August 2015. The PBoC sold dollars to prevent the yuan from falling further. Further, the slowing Chinese economy resulted in large capital outflows from the country. In December 2015, China’s foreign reserves fell $107.9 billion—its largest monthly drop. Meanwhile, in 2015, foreign exchange reserves fell $512.7 billion to $3.3 trillion, which is the largest yearly drop on record.

Hedge fund managers’ opinion of the yuan

Kyle Bass, founder of Hayman Capital Management, is still bearish on the yuan. Before the release of the foreign exchange reserve data, he stated, “This is going to take years to play out, and monthly numbers don’t mean anything.” He was of the opinion that the foreign exchange imbalance is too large, and an increase in money supply would put downward pressure on the yuan, which would eventually call for further easing in monetary policy.

Earlier, George Soros, founder of Soros Fund Management, and William Ackman, founder and CEO of Pershing Square Capital Management, had taken a notional short position on the yuan.

Bumpy road ahead

The steps taken by China to curb the outflow of Chinese currency has worked to some extent. However, we still expect capital to move out of the country at least for the time being due to the fragile nature of the Chinese economy. It wouldn’t be surprising if the PBoC further loosened its monetary policy to support its slowing economy.

Impact on mutual funds

Among China-focused mutual funds, the Clough China Fund Class A (CHNAX), the Fidelity Advisor China Region Fund Class A (FHKAX), the John Hancock Greater China Opportunities Fund Class A (JCOAX), and the Matthews China Fund Investor Class (MCHFX) are not impacted by the decline in foreign reserves.

However, the revenues of multinational companies such as Taiwan Semiconductor Manufacturing (TSM), Lenovo Group (LNVGY), Baidu (BIDU), NetEase (NTES), and China Mobile (CHL) may take a hit due to currency fluctuation.

Although the overall rise in foreign reserves may have little impact on the performance of China-focused mutual funds or ADRs (American depository receipts), it reveals that the Chinese government is taking all possible steps to prop up the slowing economy, which is good for China’s financial markets.