What Will Hurt Mead Johnson’s 2Q16 Revenue?

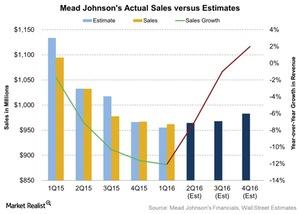

Analysts are expecting Mead Johnson’s revenue to be $964 million for 2Q16. That’s a fall of 7% compared to 2Q15 revenues of $1.0 billion.

July 22 2016, Updated 1:05 p.m. ET

Revenue contributors

Mead Johnson Nutrition Company’s (MJN) major revenue contributors are its three geographical segments: Asia, Latin America, and North America/Europe. The Asia segment contributes to 45%–55% of Mead Johnson’s revenue every quarter.

Revenue expectations for upcoming quarters

Analysts are expecting Mead Johnson’s revenue to be $964 million for 2Q16. That’s a fall of 7% compared to 2Q15 revenues of $1.0 billion. In the last six quarters, the company has missed estimates four times. However, the company was in line with estimates in 4Q15 and surpassed estimates by a mere 0.72% in 1Q16.

For 3Q16, analysts expect revenue to fall by 1%. However, they expect a rise of 2% in 4Q16. For the full year 2016, analysts expect revenue to be around $3.9 billion, a fall of 5% compared to 2015 revenue of $4.1 billion. A strong US dollar compared to most currencies has been a headwind lately for US companies with international operations. Three-fourths of Mead Johnson’s operations are international, so foreign exchange had a substantial impact on the company’s sales in 2015. The effect of currency translation is expected to continue in 2016.

Expectations for 2016

The company expects its 2016 constant dollar sales to be 0%–2% above sales in fiscal 2015. On a reported basis, sales are projected to be 4%–6% lower than sales in 2014. This estimate comes with the assumption that exchange rates will remain at the current level. Management also mentioned that even though it expects improvement in the second quarter performance, sales will struggle on a constant dollar basis.

Revenue estimates for peers

Mead Johnson’s peers in the packaged food industry include Campbell Soup (CPB), Pinnacle Foods (PF), and Snyders-Lance (LNCE).

- Campbell’s revenue for fiscal 4Q16 is expected to increase by 1%.

- Pinnacle’s revenue for fiscal 2Q16 is projected to increase 20%.

- Snyder’s-Lance’s revenue for fiscal 2Q16 is expected to increase 43%.

To gain exposure to Campbell, you can invest in ETFs such as the PowerShares Dynamic Food and Beverage ETF (PBJ), which invests ~3% in CPB as of July 15, 2016. The iShares Russell Midcap Value ETF (IWS) invests 0.34% in MJN.