What Do Analysts Recommend for Priceline?

Priceline’s consensus 12-month target price is $1,479.55, which indicates an 11.5% return potential.

Nov. 20 2020, Updated 4:44 p.m. ET

Analyst views

Analysts’ recommendations or changes to recommendations can tell us about how the analysts think the industry and business environments will change in the quarters ahead. The recommendations can also have a significant impact on the stock price.

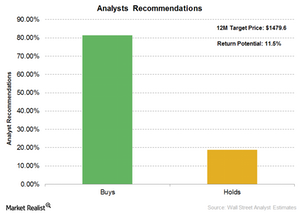

According to the Bloomberg consensus, out of the 32 analysts tracking Priceline (PCLN), 81.3% have a “buy” recommendation and 18.8% have a “hold” rating.

Ahead of Priceline’s earnings on August 4, 2016, all analysts have maintained their rating for Priceline’s stock after the first quarter results. Some analysts have also raised their target prices for the stock.

Target price

Priceline’s consensus 12-month target price is $1,479.55, which indicates an 11.5% return potential as of the July 22 closing price of $1,327.4. Brian P Fitzgerald from Jefferies has maintained his “buy” rating with the highest price target of $1,660. Mark Mahaney from RBC Capital Markets has the second highest target price of $1,600 and has maintained the “outperform” rating. Goldman Sachs has the second lowest price target of $1,250 with a “neutral” rating on the stock. Cyrus Mewawalla from CM Research has the lowest target price of $1,061.5 with a “sell” rating on the stock. Priceline forms 8.5% of the Nasdaq Internet Portfolio (PNQI).

Analyst estimates

For 2016, analysts estimate sales to grow by 15% to $10.6 billion compared to the 9% growth in 2015. EBITDA is expected to grow by 13% to $4,212 million as compared to the 7.5% growth seen in 2015.

In the next few articles, we’ll discuss what led to these estimates, helping investors judge if analysts are being optimistic or conservative on the stock. We’ll also help you understand what may be priced into the stock.

For more industry updates, visit Market Realist’s pre-earnings analysis for Priceline’s rival Expedia (EXPE). We’ll also cover pre-earnings expectations for PCLN’s competitors TripAdvisor (TRIP) and Ctrip (CTRP). Check out Market Realist’s Online Travel page for the latest updates.