How Do US Economic Numbers Play on Gold?

Economic data from the United States on Tuesday, July 21, 2016, on home starts and building permits affected gold and other precious metals to a certain extent.

Dec. 4 2020, Updated 10:53 a.m. ET

Housing starts and permits

Economic data from the United States on Tuesday, July 21, 2016, on home starts and building permits affected gold and other precious metals to a certain extent. The US dollar hit a four-month high after data showed a surge in housing starts in June.

Housing starts measure the annualized number of new residential buildings that began construction in the previous month. The figure stood at 1.19 million, which was higher than the forecast figure of 1.17 million. Building permits held as expected, thus continuing to help Market sentiment.

Positive sentiment from these economic numbers may likely guide the United Nations to make its liftoff decision, although it seems quite distant amid global fears. Investors pondered over some disappointing earnings reports and signs that the United Kingdom’s decision to leave the European Union could continue to hurt other economies.

Liftoff delayed

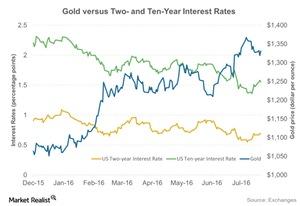

The delay in the liftoff decision gave plenty of leg room to precious metals. Since they’re non-interest-bearing assets, their opportunity cost rises with the hike in Treasury rates. But a delay did give them some breathing room.

Precious metals often rise during times of uncertainty and after the postponement of interest rate hikes. When both of these happen together, precious metals strengthen.

The increase in precious metals took mining funds with them, including the Sprott Gold Miners ETF (SGDM) and the Global X Silver Miners ETF (SIL). These two funds rose 114.5% and 156.6%, respectively, on a year-to-date basis.

Mining shares also witnessed surging prices. Kinross Gold (KGC), Alacer Gold (ASR), and Eldorado Gold (EGO) rose 180.2%, 49.5%, and 29.2%, respectively, on a year-to-date basis. Together, these miners make up 7.9% of the fluctuations in the VanEck Vectors Gold Miners ETF (GDX).