What Does the Precious Metal Correlation Suggest?

Gold and silver have a strong correlation close to 75%. This suggests that about 75% of the time, a fall in gold prices leads to a fall in silver prices.

Aug. 1 2016, Updated 9:11 a.m. ET

Rising precious metals

Precious metals have had a remarkable performance this year. Haven bids gave them a lift. Gold, silver, platinum, and palladium have seen year-to-date gains of 26.5%, 46.6%, 28.7%, and 25.3%, respectively. The unrest after the Brexit vote and the turbulence at the beginning of the year due to the oil market helped these metals.

When understanding the performance of these metals, it’s crucial to know their interrelationship. Gold, silver, and platinum are famously known as havens. Palladium is often closely associated with industrial metals. The performance of equities can also considerably impact the performance of palladium.

Correlations to gold

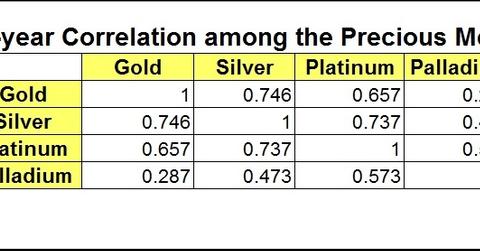

As seen in the above table, gold and silver have a strong correlation close to 75%. This suggests that about 75% of the time, a fall in gold prices leads to a fall in silver prices. Platinum, however, is comparatively less correlated to gold, about 66%. Palladium seems to have the least correlation to gold at approximately 29%.

The correlation to gold suggests how closely or distantly metals follow investors’ haven bids.

Correlations to silver

Silver has shown a strong correlation to platinum close to 0.74, suggesting that platinum may more closely associate with silver than gold. Also, as silver has high industrial use like palladium, silver and palladium walk together about 74% of the time.

Platinum and palladium individually seem to be quite correlated. However, their correlation is only 0.57. That suggests that only 57% of the time will they change in the same direction.

Funds can carefully study the changes in these metals. The Physical Platinum Shares (PPLT), the Physical Palladium Shares (PALL), the Physical Silver Shares (SIVR), and the Physical Swiss Gold Shares (SGOL) have risen 16.2%, 22.4%, 14.5%, and 2.2%, respectively, on a 30-day trailing basis.