Nucor Looks to Contract Resets to Further Improve Performance

Nucor (NUE) expects its 3Q16 performance to improve as compared to 2Q16. The key driver of Nucor’s 3Q16 performance would be the reset of contracts.

Dec. 4 2020, Updated 10:53 a.m. ET

Nucor

Nucor (NUE) expects its 3Q16 performance to improve as compared to 2Q16. The key driver of Nucor’s 3Q16 performance would be the reset of contracts. Contract sales represent 60% of Nucor’s sheet volumes. As these contracts are reset to reflect the current pricing environment, Nucor’s earnings could improve significantly in the second half of the year.

Notably, other steelmakers such as U.S. Steel (X), AK Steel (AKS), and ArcelorMittal (MT) could also see a sequential increase in their 2H16 earnings as contract sales are reset at higher prices.

Import pressure

Also, Nucor does not see any major import pressure later this year as some analysts are projecting. According to Nucor, its customers don’t see much difference between domestic steel prices and final landed costs of imported steel.

Because there is a lead time between placing import orders and receiving the final delivery—which can take up to six months—steel buyers might refrain from placing orders now to limit their year-end steel inventories,

Our take

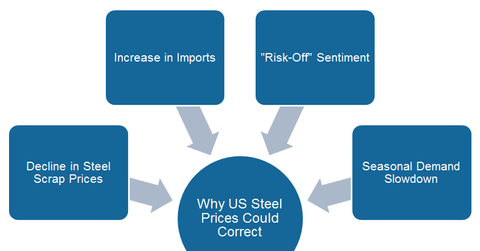

We might not see imports swelling immediately, but we have already started to see a small uptick in US (DIA) steel imports. We might have seen the best of US steel prices for 2016. There looks to be scope for more downward correction in steel prices.

Spot HRC (hot rolled coil) prices could fall toward $550 per short ton by the end of the year. More downward pressure on steel scrap prices, an increase in imports, the seasonal slowdown in steel demand, and increasing “risk-off” sentiments could be the key factors driving steel prices lower.

You can also read Steel Industry Mid-Year Review: Can the Party Continue? to explore the outlook for the US steel industry.

You can also visit our Steel page for other recent developments in this industry.