Mondelez’s Revenue Expectations for Rest of Fiscal 2016

In its fiscal 1Q16, Mondelez International (MDLZ) reaffirmed the fiscal 2016 outlook it announced during its 4Q15 results.

July 25 2016, Updated 11:04 a.m. ET

Revenue expectations

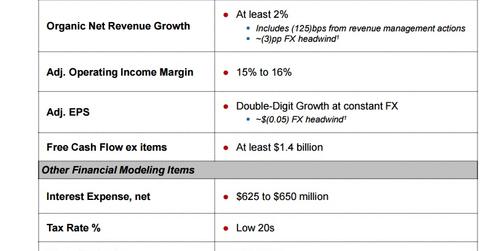

In its fiscal 1Q16, Mondelez International (MDLZ) reaffirmed the fiscal 2016 outlook it announced during its 4Q15 results. The company expects organic net revenue growth of at least 2%. This estimate includes a 125-basis-point headwind from trade optimization and elimination of less profitable SKUs.

The company now expects a currency headwind impact of three points on revenue, less than the six points expected earlier. This estimate is based on current exchange rates.

Operating margin and EPS expectations

For 2016, Mondelez expects adjusted operating profit margin to be in the range of 15% to 16%, an expansion of 200 basis points compared to 2015. It expects the margin to be at the lower end of the range mainly because of an impact of a 50-basis-point headwind related to the deconsolidation of the company’s operations in Venezuela. The company also expects an operating margin of 17% to 18% in fiscal 2018.

Peer J.M. Smucker’s (SJM) EPS is expected to be $7.72 for fiscal 2017. ConAgra Foods’ (CAG) and General Mills’ (GIS) EPS is expected to be $2.41 and $3.11 for 2017, respectively. To gain exposure to Mondelez, you can invest in the First Trust NASDAQ-100 Ex-Technology Sector IndexSMFund (QQXT) and the First Trust NASDAQ-100 Equal Weighted IndexSMFund (QQEW). These funds invest 3% of their combined holdings in the stock.

Mondelez also expects adjusted EPS to deliver double-digit growth on a constant currency basis. The adverse effect of currency translation is now expected to be $0.05 down from the earlier estimate of $0.13.

Other expectations

The company expects interest expense to be around $625 million–$650 million and the full-year 2016 tax rate to be in the low 20% range.