Why Leveraged Loan Funds Saw Outflows Last Week

According to S&P Capital IQ Leveraged Commentary & Data, three collateralized loan obligation deals worth $1.4 billion were priced last week.

Nov. 20 2020, Updated 3:47 p.m. ET

CLO deals

According to S&P Capital IQ Leveraged Commentary & Data, three collateralized loan obligation (or CLO) deals worth $1.4 billion were priced last week. Two CLO deals worth $1.3 billion had been priced in the previous week. The year-to-date (or YTD) CLO issuance stands at $17.6 billion.

Leveraged loan funds saw outflows last week

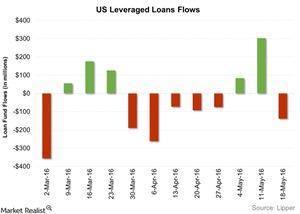

According to data from Lipper, leveraged loan funds saw outflows last week after two consecutive weeks of inflows. The amount of the outflow was small, coming in at $139 million during the week ended May 18, 2016.

In the previous week, leveraged loan funds had seen inflows of $303 million. With last week’s outflows, total net outflows from leveraged loan funds stood at $5.0 billion as of May 18, 2016.

In comparison, high yield bond funds recorded inflows of $1.1 billion, while equity funds recorded large outflows of $3.9 billion last week. Equity funds had witnessed inflows of $6.1 billion in the previous week.

Senior loans are tracked by mutual funds such as the Oppenheimer Senior Floating Rate Fund Class A (OOSAX) and the Fidelity Advisor Floating Rate High Income Fund Class A (FFRAX). Investors can also take exposure to senior loans through ETFs such as the Invesco PowerShares Senior Loan Portfolio ETF (BKLN) and the Highland/iBoxx Senior Loan ETF (SNLN).

Leveraged loan issuance gained traction last week. Cision, Pilot Travel Centers, Nexeo Solutions, and US Farathane were some of the issuers of leveraged loans last week.

Returns on leveraged loans

Returns on leveraged loans rose in the week ended May 20, 2016. The S&P/LSTA U.S. Leveraged Loan 100 Index rose 0.3% last week. The index has risen by 5.1% YTD.

Meanwhile, the Oppenheimer Senior Floating Rate Fund Class A (OOSAX), which provides exposure to senior loans, rose 0.4% week-over-week. YTD, OOSAX has risen 3.9%. The Highland/iBoxx Senior Loan ETF (SNLN), which also provides exposure to senior loans, rose 0.3% week-over-week. It has risen by 4.1% YTD.

For more mutual funds analysis, please visit Market Realist’s Mutual Funds page.