Why Kansas City Southern’s Operating Margin Rose in 2Q16

Kansas City Southern (KSU) reported a 3% decline in 2Q16 revenues to $568.5 million on a YoY (year-over-year) basis.

July 28 2016, Updated 11:04 a.m. ET

Kansas City Southern’s operating margin

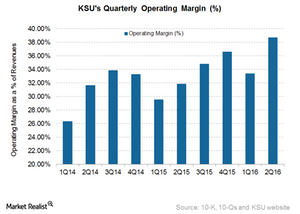

Kansas City Southern (KSU) reported a 3% decline in 2Q16 revenues to $568.5 million on a YoY (year-over-year) basis. On the other hand, KSU’s operating expenses fell by 12.6% to $348.6 million in 2Q16 compared with $399.0 million in 2Q15. In 2Q16, KSU’s operating margin was 38.7%, a rise of 679 basis points over the corresponding quarter in 2015.

Note that most of this improvement was due to a positive impact of Mexican fuel excise tax credit of $34.0 million. On a comparative treatment basis, the operating margins have actually gone up by 350 basis points in 2Q16. In the last eight years, KSU’s operating margin has improved by over 12%.

Major operating expenses

In 2Q16, KSU’s compensation and benefits expenses rose by 1% compared with 2Q15. Higher incentive compensation and wage inflation offset the lower employee expenses on account of lower US manpower.

Fuel charges for KSU fell by 20.5% to $61.6 million in 2Q16 on a YoY basis. Fuel charges were positively impacted by foreign exchange fluctuations and lower fuel prices. The average locomotive fuel price in the United States was $1.45 per gallon in 2Q16 against $1.96 in 2Q15.

In 2Q16, KSU’s purchased services expenses were $53.7 million, down 5.8% compared with 2Q15. Restructuring of the maintenance contract and reduced repairs resulting from lower volumes decreased overall purchased services in 2Q16.

Outlook

KSU has taken a host of initiatives to tackle uncertainties related to volume and revenues in 2016. The company is implementing fuel optimization technology in ~20% of road locomotives in the United States. It plans to replicate this in Mexico moving forward. It has planned reorganization in the network operations center and various field locations. KSU has also undertaken an automatic shutdown technology initiative.

Moving forward, railroad companies are likely to focus on cost rather than on revenue. Below are the 1Q16 operating margins of KSU’s peers:

- Union Pacific Corporation (UNP): 34.9%

- Canadian National Railway (CNI): 41.1%

- Canadian Pacific Railway (CP): 41.1%

- Norfolk Southern Corporation (NSC): 29.9%

- CSX Corporation (CSX): 26.9%

- Genesee and Wyoming (GWR): 16.5%

All the US-originated Class I railroads are included in the iShares Global Industrials ETF (EXI). Keep reading to learn about KSU’s stock buyback initiative.