Inside the ClearBridge Aggressive Growth Fund Portfolio

The sectoral breakdown of SHRAX is unlike any other mutual fund in this review, with healthcare as its biggest holding, commanding 35% of the portfolio.

Oct. 24 2016, Published 3:06 p.m. ET

ClearBridge Aggressive Growth Fund overview

The ClearBridge Aggressive Growth Fund Class A (SHRAX) “invests primarily in common stocks of companies the portfolio managers believe are experiencing, or will experience, growth in earnings exceeding the average rate of earnings growth of the companies which comprise the S&P 500 Index. The fund may invest in the securities of large, well-known companies offering prospects of long-term earnings growth. However, because higher earnings growth rates are often achieved by small to medium capitalization companies, a significant portion of the fund’s assets may be invested in the securities of such companies.”

The fund website describes the fund management as a “patient” management that intends to grow capital by investing in a high-conviction portfolio of companies with new or innovative technologies, products, and services.

The fund’s assets were invested across 77 holdings as of September 2016, and it was managing assets worth $11.8 billion. Its September equity holdings included UnitedHealth Group (UNH), Seagate Technology (STX), Citrix Systems (CTXS), TE Connectivity (TEL), and Weatherford International plc (WFT).

Portfolio changes in SHRAX

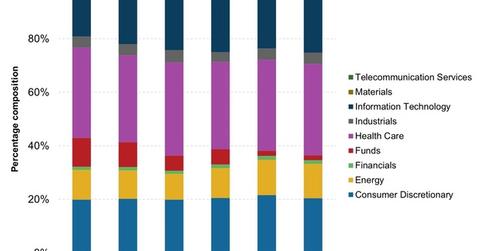

The sectoral breakdown of SHRAX is unlike any other mutual fund in this review. It has healthcare as its biggest sectoral holding. The sector commands 35% of the fund’s portfolio. Information technology, consumer discretionary, and energy are other core components of the fund’s portfolio. Apart from these, no other sector has 10% or more allocated to it. The top three sectors combined make up nearly 80% of all assets.

Notably, SHRAX is the only fund of the 12 in this review that has double-digit exposure to the energy sector and does not invest in the consumer staples space. The fund is not invested in real estate or in utilities, and it initiated exposure to the telecom services sector in 3Q15.

The fund considers the Russell 3000 Growth Index as its benchmark. Compared to this index, the fund is markedly overweight the healthcare sector, which makes up twice the percentage healthcare forms in the benchmark. SHRAX is also sharply overweight the energy sector, which makes up just 0.7% of the benchmark, and the fund is underweight every other sector, most notably industrials, tech, and financial. We should also point out that the fund website claims that the fund managers are “benchmark agnostic.”

A closer look at the quarterly portfolios of the fund for the past three years until September 2016 shows a rise in exposure to healthcare, tech, and materials stocks, whereas exposure to energy and materials has fallen.

But has this unique positioning helped or hurt SHRAX’s performance so far in 2016? We’ll explore this question in the next article.