Inflation Levels in Malaysia Ease, Taiwanese Export Orders Drop

The inflation rate in Malaysia increased by 1.6% on an annual basis in June—compared to 2.0% in the previous month and below forecasts of 1.6%.

July 21 2016, Published 7:19 a.m. ET

Inflation rate eases in June

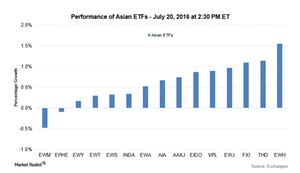

The inflation rate in Malaysia increased by 1.6% on an annual basis in June—compared to 2.0% in the previous month and below forecasts of 1.6%. Growth in consumer prices has fallen for the fourth consecutive month in Malaysia—the lowest level since March 2015. On a monthly basis, inflation levels in Malaysia increased by 0.2%—compared to a 0.3% gain in the previous month. The fall in inflation growth was driven by a fall in transportation costs, while food costs rose slightly. Recently, Malaysia’s central bank cut its benchmark interest rate by 25 basis points to 3.0% and revised its inflation forecasts downward from 2.5%–3.5% to 2.0%–3.0% for the current year. The iShares MSCI Malaysia (EWM) fell by 0.48% on July 20 at 2:30 PM EST.

Export orders fall for the 15th consecutive month

Export orders in Taiwan continued to decline in June by 2.4% on an annual basis—compared to a 5.8% fall in the previous month. The fall was the 15th consecutive contraction in the South Asian economy. It recorded the highest number of prolonged declines. The declines were recorded mainly in Mainland China, Hong Kong, Japan, and Canada. Export shipments to the US and Europe exhibited modest growth. On the macroeconomic front, Taiwan’s industrial production, retail sales, and the unemployment rate are expected to release on Friday. This will guide the index more. The iShares MSCI Taiwan (EWT) and the iShares MSCI All Country Asia ex Japan (AAXJ) rose by 0.30% and 0.72%, respectively, on July 20 at 2:30 PM EST.

Australia’s leading economic index contracts

Australia’s leading economic index from Westpac fell by 0.2% in June following a 0.2% rise in the previous month. Australian indices recovered on Wednesday after falling in the previous session as the Reserve Bank of Australia kept the door open for more rate cuts to step up inflationary pressures. However, the Australian dollar was still trading on a negative note compared to the US dollar. The iShares MSCI Australia (EWA) and the Vanguard FTSE Pacific (VPL) rose by 0.52% and 0.90%, respectively, on July 20 at 2:30 PM EST.