In Line with These Competitors, Expedia’s Margins to Increase

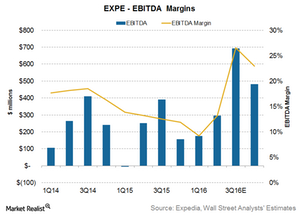

For 2Q16, analysts are estimating Expedia’s (EXPE) EBITDA to grow by 17% to $296 million with an EBITDA margin of 13%.

July 26 2016, Updated 11:05 a.m. ET

Analyst estimates

For 2Q16, analysts are estimating Expedia’s (EXPE) EBITDA[1. earnings before interest, tax, depreciation, and amortization] to grow by 17% to $296 million with an EBITDA margin of 13%. EBITDA growth is expected to increase to 47.6% and 72% in 3Q16 and 4Q16, respectively. This is due to an increase in EBITDA margins to 26.5% and 22.9% in 3Q16 and 4Q16, respectively.

EBITDA margins are expected to increase to 19% in 2016 and then rise to 20% in 2017. As a result, EBITDA growth is expected to increase to 49% and 25% in 2016 and 2017, respectively, which is much higher than the growth seen in 2015.

Priceline’s (PCLN) margins are expected to increase to 40.6% in 2016 from 38% in 2015. TripAdvisor’s (TRIP) margins are expected to increase from 22% in 2015 to 28.7% in 2016, and Ctrip.com’s (CTRP) margins are expected to decline to 4.4% in 2016 from 6.4% in 2015.

Marketing expenses play spoilsport

EXPE has been increasing marketing expenses in a bid to capture market share. Most of this spending has gone to Google (GOOGL). For 1Q16, EXPE’s marketing expenses increased by 42% due to increased promotional costs as well as increased pace of hiring.

Another cost that rose significantly in the quarter is technology and content expenses, due to high personnel costs and low capitalization rates.

eLong sale

Expedia sold a 62.4% stake in eLong earlier in 2015—a move that became a key driver behind the company’s return to profitability in 3Q15. The Chinese company had initially impacted Expedia’s bottom line negatively, and it is expected to continue to do so, although the effects will be much softer moving forward. As a result, margins are expected to improve.

Outlook

Increasing marketing spending and the strong US dollar will continue to be a drag on EXPE’s short-term revenues. On the other hand, the eLong sale will provide respite to Expedia’s margins.

Expedia has maintained its adjusted EBITDA guidance. It expects its adjusted EBITDA to grow by 35%–45% in 2016. Approximately $275 million–$325 million is expected to be contributed by EXPE’s two major acquisitions in 2016—Orbitz and Homeaway.

EXPE forms ~1.3% holding of the S&P 500 Pure Growth ETF (RPG).