AptarGroup Declares Quarterly Dividend of $0.30 Per Share

AptarGroup (ATR) has a market cap of $5.0 billion. It fell by 0.22% to close at $80.23 per share on July 13, 2016.

July 14 2016, Published 3:59 p.m. ET

Price movement

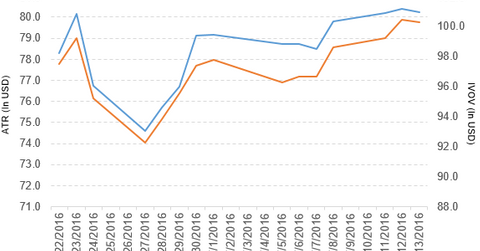

AptarGroup (ATR) has a market cap of $5.0 billion. It fell by 0.22% to close at $80.23 per share on July 13, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 1.9%, 4.5%, and 11.3%, respectively, on the same day. ATR is trading 3.0% above its 20-day moving average, 4.0% above its 50-day moving average, and 8.5% above its 200-day moving average.

Related ETF and peers

The Vanguard S&P Mid-Cap 400 Value ETF (IVOV) invests 0.65% of its holdings in AptarGroup. The ETF tracks an index of primarily mid-cap US stocks. The index uses three factors to select value stocks from the 400 stocks chosen by the S&P committee. The YTD price movement of IVOV was 13.4% on July 13.

The market caps of AptarGroup’s competitors are as follows:

AptarGroup declares dividend

AptarGroup has declared a quarterly cash dividend of $0.30 per share on its common stock. The dividend will be paid on August 17, 2016, to shareholders of record at the close of business on July 27, 2016.

In other news, Stephen Hagge, AptarGroup’s president and chief executive officer, is planning to retire at the end of the year and will continue to serve as a director of the company.

Performance in 1Q16

AptarGroup reported 1Q16 net sales of $582.3 million, a fall of 1.3% from the net sales of $589.8 million in fiscal 1Q15. Sales of the Beauty + Home segment fell by 4.6%. Sales of the Pharma and Food + Beverage segments rose by 2.5% and 3.9%, respectively, between 1Q15 and 1Q16.

Its net income and EPS (earnings per share) fell to $43.9 million and $0.67, respectively, in 1Q16, compared with $45.2 million and $0.70 in 1Q15. It reported adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) of $112.0 million in 1Q16, a rise of 4.4% over 1Q15.

AptarGroup’s cash and cash equivalents fell by 21.2% and its inventories rose by 6.9% between 4Q15 and 1Q16. In 1Q16, its current ratio and debt-to-equity ratio fell to 2.4x and 1.11x, respectively, compared with $3.1x and 1.12x in 4Q15.

Projections

The company made several projections for 2Q16.

- It expects core sales growth from the Pharma and Food + Beverage segments.

- It expects core sales growth for the Beauty + Home segment. This excludes any positive impact from the Mega Airless acquisition.

- It expects EPS of $0.87–$0.92. This estimate includes a ~$0.02 per share positive impact from the Mega Airless acquisition.

Let’s take a look at Bemis Company.