How Does a Rate Hike Impact Insurance Stocks?

Interest rates are a key performance driver for life insurance companies, affecting their margins, hedging costs, and product sales.

June 1 2016, Published 3:46 p.m. ET

Insurers gain from rising expectations of a rate hike

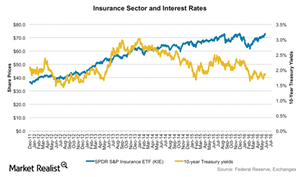

Life insurance companies are eagerly waiting for the Fed to start raising interest rates (TLT). The life insurance sector is a direct beneficiary of a rise in interest rates. In the five-day period ended May 27, the SPDR S&P Insurance ETF (KIE) generated returns of 1.6% on increasing expectations of a rate hike in June. Large insurance players Prudential Financial (PRU), MetLife (MET), and American International Group (AIG) recorded gains of 2.4%, 2.6%, and 2.3% last week.

Margin pressures ease if interest rates rise

Interest rates are a key performance driver for life insurance companies, affecting their margins, hedging costs, and product sales. Low interest rates directly affect margins of insurers, as they price their products using expected long-term average rates. Rising interest rates are beneficial for life insurance companies because they derive their investment income from investing premiums in corporate and government bonds. Yields and coupons on these bonds rise in response to a rise in Fed fund rates and bank interest rates. This enables life insurers to invest their premiums at higher yields and earn higher investment income, expanding their profit margins. Margin pressures on life insurers have eased.

The Fed is a data-driven team, and a positive trajectory in indicators could lead to a rate hike soon. The way forward is a rising yield curve, which translates to greater profitability for life insurers.